Question: Question 27 (5 points) a) Smith Contracting Inc. is considering the purchase of a new dump truck for $100,000. If this vehicle can be depreciated

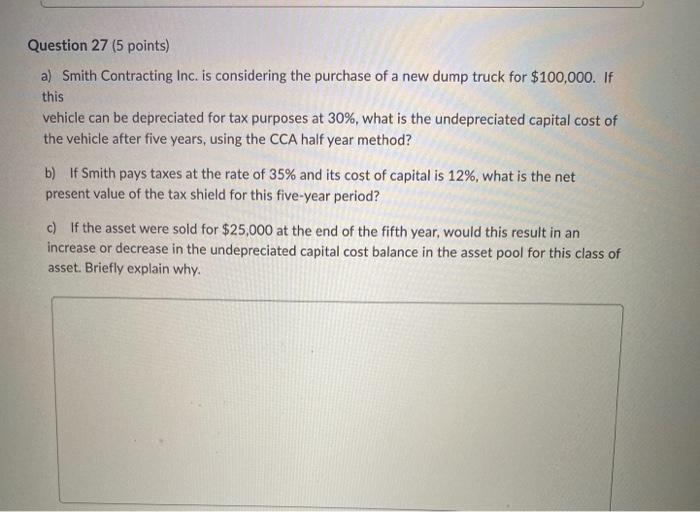

Question 27 (5 points) a) Smith Contracting Inc. is considering the purchase of a new dump truck for $100,000. If this vehicle can be depreciated for tax purposes at 30%, what is the undepreciated capital cost of the vehicle after five years, using the CCA half year method? b) If Smith pays taxes at the rate of 35% and its cost of capital is 12%, what is the net present value of the tax shield for this five-year period? c) If the asset were sold for $25,000 at the end of the fifth year, would this result in an increase or decrease in the undepreciated capital cost balance in the asset pool for this class of asset. Briefly explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts