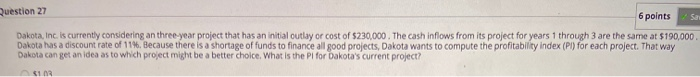

Question: Question 27 6 points sa Dakota, Inc. is currently considering an three-year project that has an initial outlay or cost of $230,000. The cash inflows

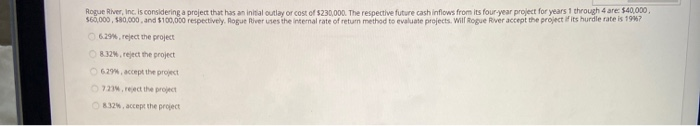

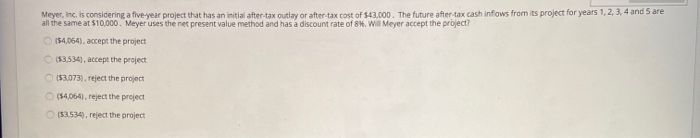

Question 27 6 points sa Dakota, Inc. is currently considering an three-year project that has an initial outlay or cost of $230,000. The cash inflows from its project for years 1 through 3 are the same at $190,000 Dakota has a discount rate of 114. Because there is a shortage of funds to finance all good projects, Dakota wants to compute the profitability Index (PI) for each project. That way Dakota can get an idea as to which project might be a better choice. What is the PI for Dakota's current project? Rogue River, Inc. is considering a project that has an initial outlay or cost of $230,000. The respective future cash inflows from its four year project for years 1 through 4 are: $40,000 $60,000, 580,000 and $100,000 respectively, Rogue River uses the Internal rate of return method to evaluate projects, Will Rogue Rver accept the project fits hurdle rate is 1987 6.29%,reject the project 8.32%,reject the project 629. accept the protect 721.react the project 32. accept the project Meyer, Inc. is considering a five-year project that has an initial after tax outlay or after tax cost of $43.000. The future after tax cash inflows from its project for years 1.2.3.4 and 5 are all the same at $10,000. Meyer uses the represent value method and has a discount rate of 8. Wil Meyer accept the project? 154,064), accept the project (53,5341, accept the project 153,073), reject the project (54.064), reject the project 153.534), reject the project Question 27 6 points sa Dakota, Inc. is currently considering an three-year project that has an initial outlay or cost of $230,000. The cash inflows from its project for years 1 through 3 are the same at $190,000 Dakota has a discount rate of 114. Because there is a shortage of funds to finance all good projects, Dakota wants to compute the profitability Index (PI) for each project. That way Dakota can get an idea as to which project might be a better choice. What is the PI for Dakota's current project? Rogue River, Inc. is considering a project that has an initial outlay or cost of $230,000. The respective future cash inflows from its four year project for years 1 through 4 are: $40,000 $60,000, 580,000 and $100,000 respectively, Rogue River uses the Internal rate of return method to evaluate projects, Will Rogue Rver accept the project fits hurdle rate is 1987 6.29%,reject the project 8.32%,reject the project 629. accept the protect 721.react the project 32. accept the project Meyer, Inc. is considering a five-year project that has an initial after tax outlay or after tax cost of $43.000. The future after tax cash inflows from its project for years 1.2.3.4 and 5 are all the same at $10,000. Meyer uses the represent value method and has a discount rate of 8. Wil Meyer accept the project? 154,064), accept the project (53,5341, accept the project 153,073), reject the project (54.064), reject the project 153.534), reject the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts