Question: Question Completion Status: 12 R 2 23 24 25 26 27 28 29 30 Close Wind Moving to another question will save this response Question

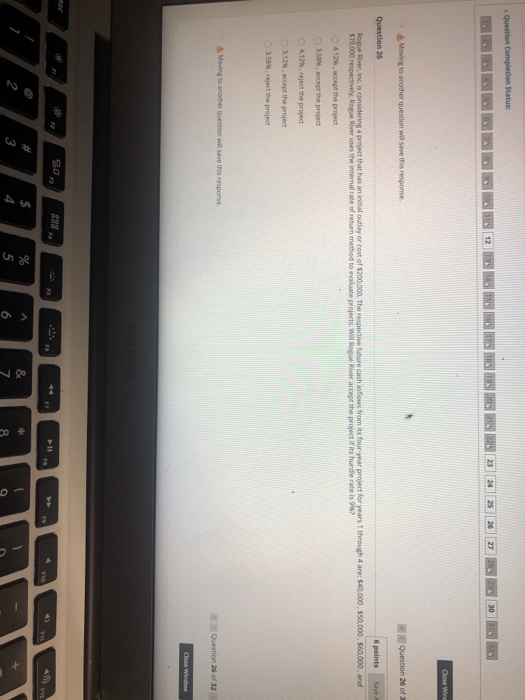

Question Completion Status: 12 R 2 23 24 25 26 27 28 29 30 Close Wind Moving to another question will save this response Question 26 of Question 26 6 points Save Rogue River, Inc. is considering a project that has an initial outlay or cost of $200,000. The respective future cash flows from its four year project for years 1 through 4 are: 500.000 $50,000 $70,000 respectively. Rogue River uses the internal rate of return method to evaluate projects. Will Rogue River accept the project if its hurdle rate is 97 $60,000. and 4.12% accept the project 3.58. accept the project 4.12.reject the project 3126.ccept the project 3:58. reject the project Moving to another question will save this response Question 26 of 32 Code Window on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts