Question: Question 27 and 28 D Question 27 1.75 pts Scott and Trish Smith are married and file a joint return. In 2020, Scott earned a

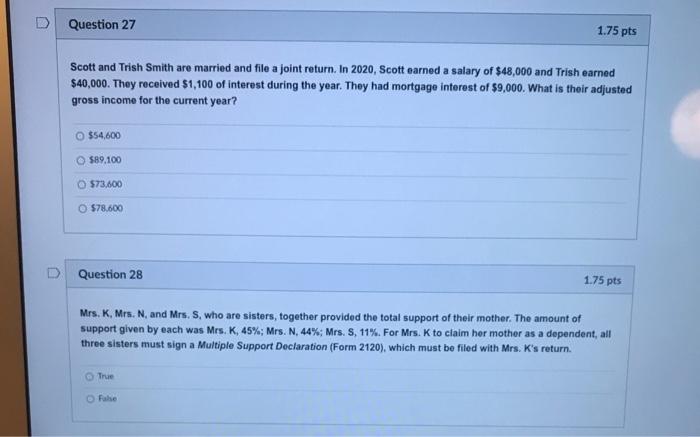

D Question 27 1.75 pts Scott and Trish Smith are married and file a joint return. In 2020, Scott earned a salary of $48,000 and Trish earned $40,000. They received $1,100 of interest during the year. They had mortgage interest of $9,000. What is their adjusted gross income for the current year? $54,600 $89.100 O $73,600 O 578.600 Question 28 1.75 pts Mrs. K. Mrs. N, and Mrs. S, who are sisters, together provided the total support of their mother. The amount of support given by each was Mrs. K. 45%; Mrs. N. 44%; Mrs. S. 11%. For Mrs. K to claim her mother as a dependent, all three sisters must sign a Multiple Support Declaration (Form 2120), which must be filed with Mrs. K's return. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts