Question: Question 28 1 pts JOHN'S OPTIONS FACT PATTERN: John get's incentive stock options in PDQ Inc. The options are for 100.000 shares at a strike

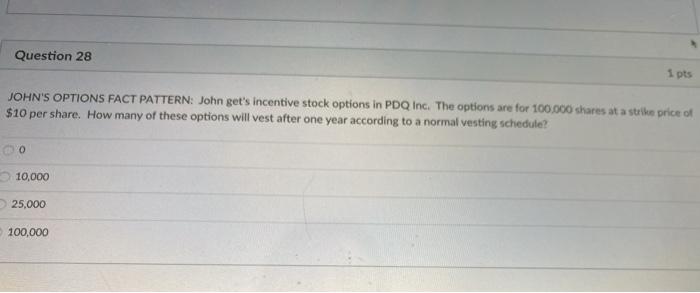

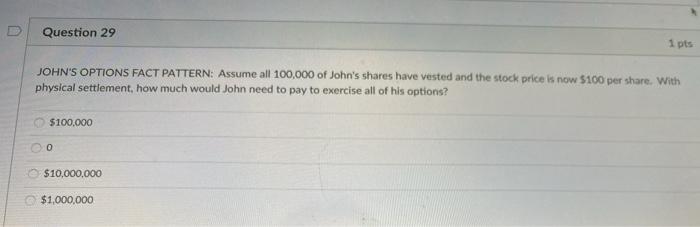

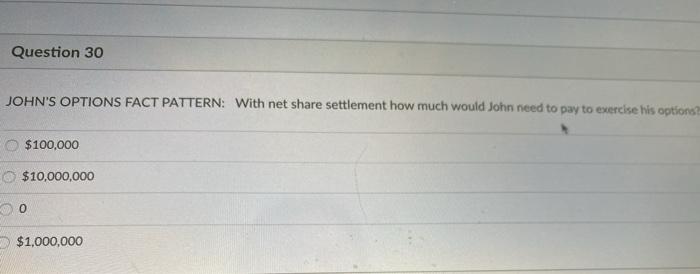

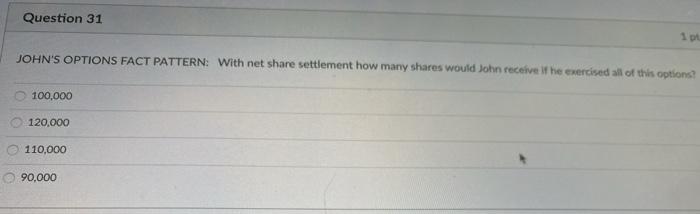

Question 28 1 pts JOHN'S OPTIONS FACT PATTERN: John get's incentive stock options in PDQ Inc. The options are for 100.000 shares at a strike price of $10 per share. How many of these options will vest after one year according to a normal vesting schedule? 0 10,000 25,000 100,000 Question 29 1 pts JOHN'S OPTIONS FACT PATTERN: Assume all 100,000 of John's shares have vested and the stock price is now $100 per share. With physical settlement, how much would John need to pay to exercise all of his options? $100,000 00 $10,000,000 $1,000,000 Question 30 JOHN'S OPTIONS FACT PATTERN: With net share settlement how much would John need to pay to exercise his options? $100,000 $10,000,000 0 $1,000,000 Question 31 JOHN'S OPTIONS FACT PATTERN: With net share settlement how many shares would John receive If he exercised all of this options? 100,000 120,000 110,000 90,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts