Question: Question 29 (3.125 points) Bauer Software Company has a bond outstanding with 18 years to maturity, a 10.72% nominal coupon, semiannual payments, and a $1.000

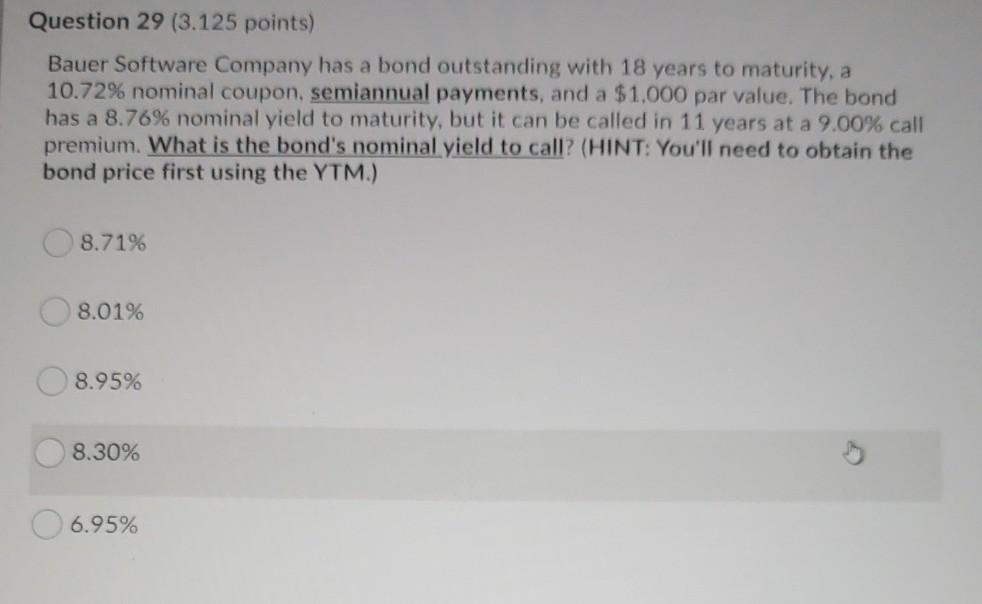

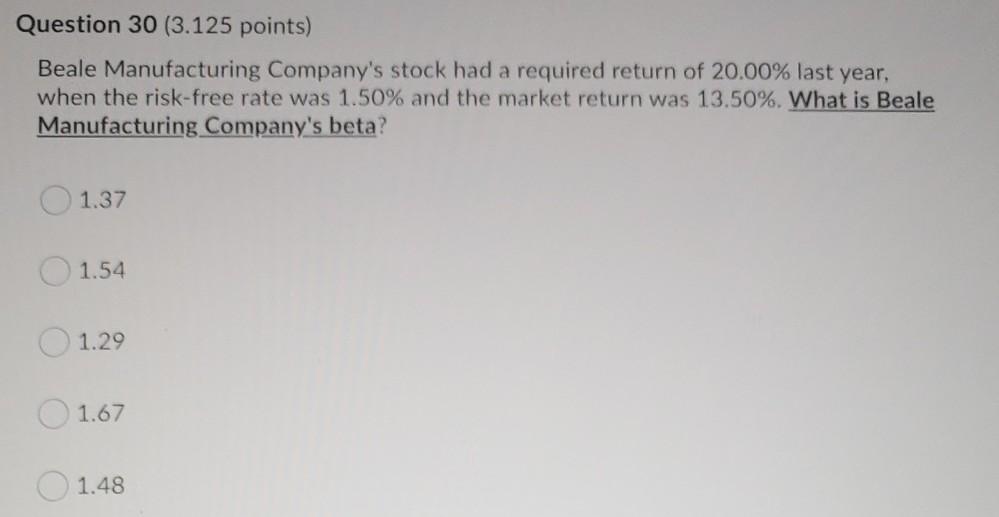

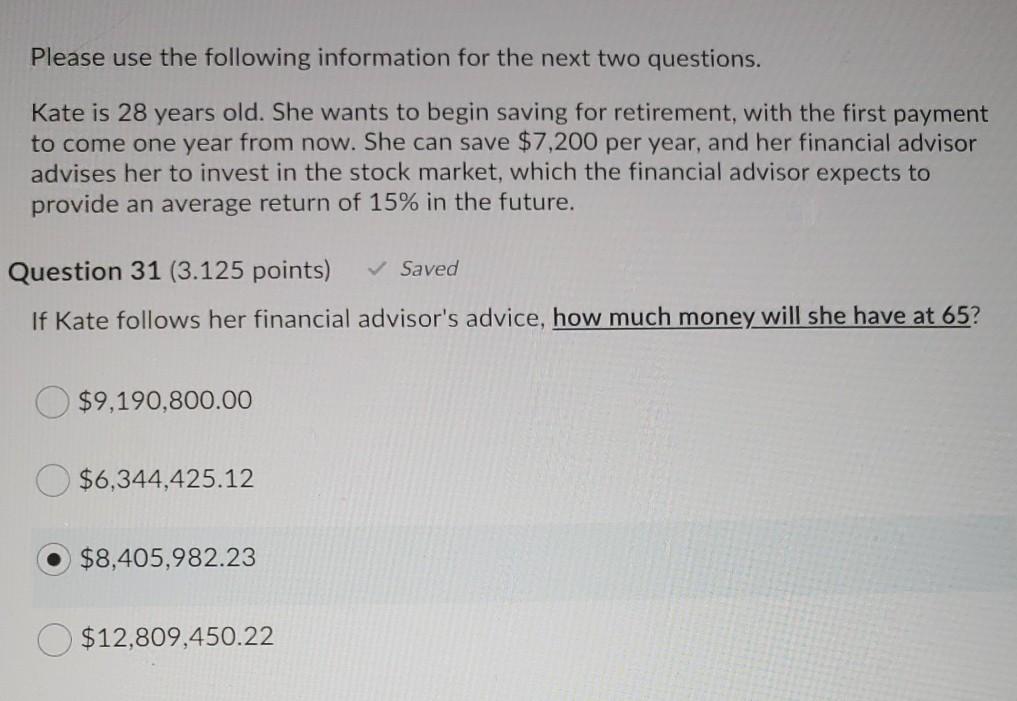

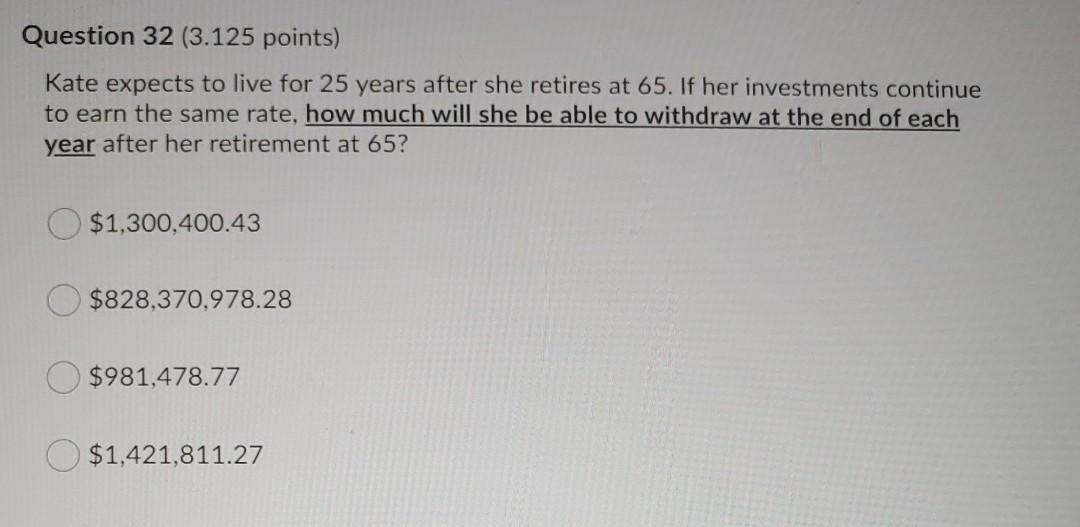

Question 29 (3.125 points) Bauer Software Company has a bond outstanding with 18 years to maturity, a 10.72% nominal coupon, semiannual payments, and a $1.000 par value. The bond has a 8.76% nominal yield to maturity, but it can be called in 11 years at a 9.00% call premium. What is the bond's nominal yield to call? (HINT: You'll need to obtain the bond price first using the YTM.) 8.71% 8.01% 8.95% 8.30% 6.95% Question 30 (3.125 points) Beale Manufacturing Company's stock had a required return of 20.00% last year, when the risk-free rate was 1.50% and the market return was 13.50%. What is Beale Manufacturing Company's beta? 1.37 1.54 1.29 1.67 1.48 Please use the following information for the next two questions. Kate is 28 years old. She wants to begin saving for retirement, with the first payment to come one year from now. She can save $7,200 per year, and her financial advisor advises her to invest in the stock market, which the financial advisor expects to provide an average return of 15% in the future. Question 31 (3.125 points) Saved If Kate follows her financial advisor's advice, how much money will she have at 65? $9,190,800.00 $6,344,425.12 $8,405,982.23 $12,809,450.22 Question 32 (3.125 points) Kate expects to live for 25 years after she retires at 65. If her investments continue to earn the same rate, how much will she be able to withdraw at the end of each year after her retirement at 65? $1,300,400.43 $828,370,978.28 $981,478.77 $1,421,811.27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts