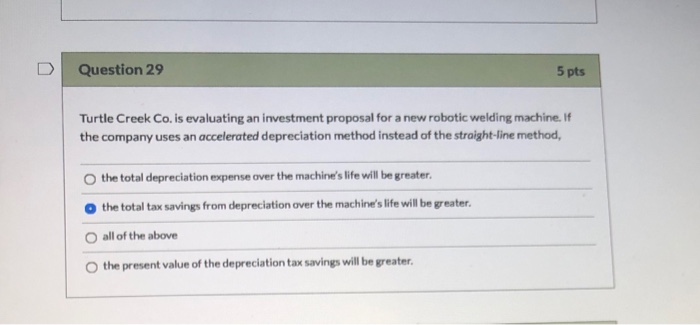

Question: Question 29 5 pts Turtle Creek Co. is evaluating an investment proposal for a new robotic welding machine. If the company uses an accelerated depreciation

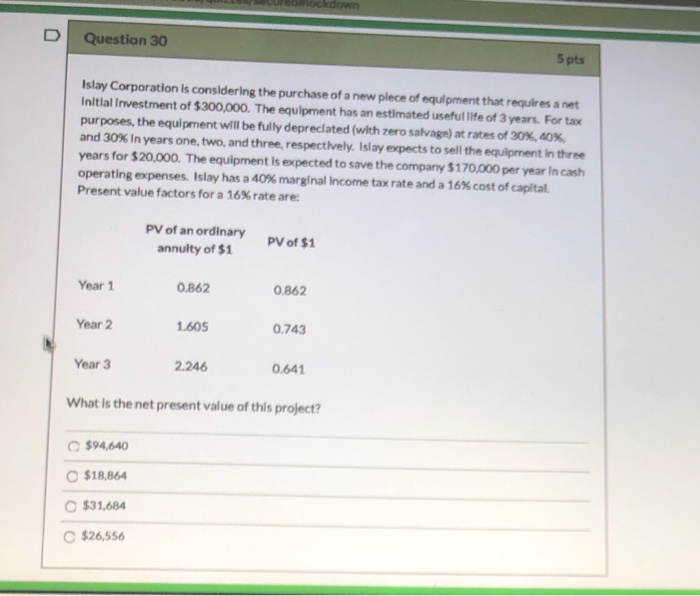

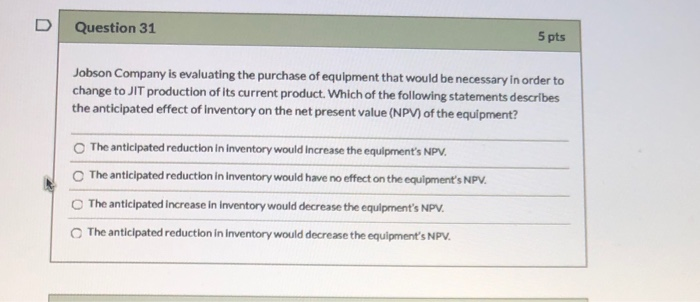

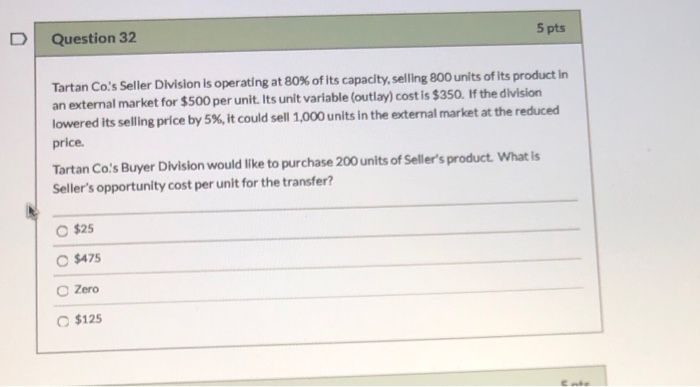

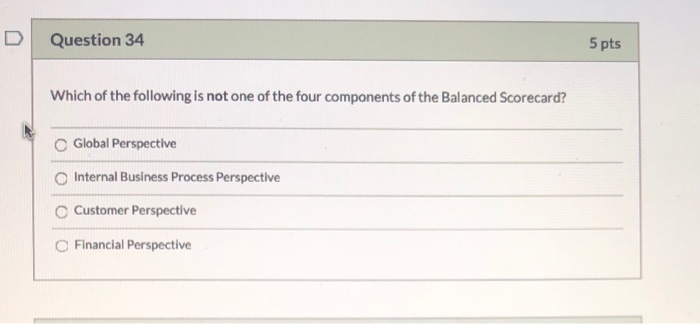

Question 29 5 pts Turtle Creek Co. is evaluating an investment proposal for a new robotic welding machine. If the company uses an accelerated depreciation method instead of the straight-line method, the total depreciation expense over the machine's life will be greater o the total tax savings from depreciation over the machine's life will be greater. all of the above the present value of the depreciation tax savings will be greater Question 30 - 5pts Islay Corporation is considering the purchase of a new plece of equipment that requires a net! Initial Investment of $300,000. The equipment has an estimated useful life of 3 years. For tax purposes, the equipment will be fully depreciated (with zero salvage) at rates of 30%, 40% and 30% In years one, two, and three, respectively. Islay expects to sell the equipment in three years for $20,000. The equipment is expected to save the company $170,000 per year in cash operating expenses. Islay has a 40% marginal Income tax rate and a 16% cost of capital Present value factors for a 16%rate are: PV of an ordinary annulty of $1 PV of $1 Year 1 0.862 0.862 Year 2 1.605 0.743 Year 3 2.246 0.641 What is the net present value of this project? $94,640 $18,864 $31,684 $26,556 Question 31 5 pts Jobson Company is evaluating the purchase of equipment that would be necessary in order to change to JIT production of its current product. Which of the following statements describes the anticipated effect of Inventory on the net present value (NPV) of the equipment? The anticipated reduction in inventory would increase the equipment's NPV. The anticipated reduction in inventory would have no effect on the equipment's NPV. The anticipated increase in Inventory would decrease the equipment's NPV. The anticipated reduction in Inventory would decrease the equipment's NPV. Question 32 5 pts Tartan Co's Seller Division is operating at 80% of its capacity, selling 800 units of its product in an external market for $500 per unit. Its unit variable (outlay) cost is $350. If the division lowered its selling price by 5%, it could sell 1,000 units in the external market at the reduced price. Tartan Co's Buyer Division would like to purchase 200 units of Seller's product. What is Seller's opportunity cost per unit for the transfer? $25 $475 Zero $125 Question 34 5 pts Which of the following is not one of the four components of the Balanced Scorecard? Global Perspective Internal Business Process Perspective Customer Perspective Financial Perspective

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts