Question: QUESTION 29 If the dividend yield for year 1 is expected to be 7% based on a stock price of $30, what will the year

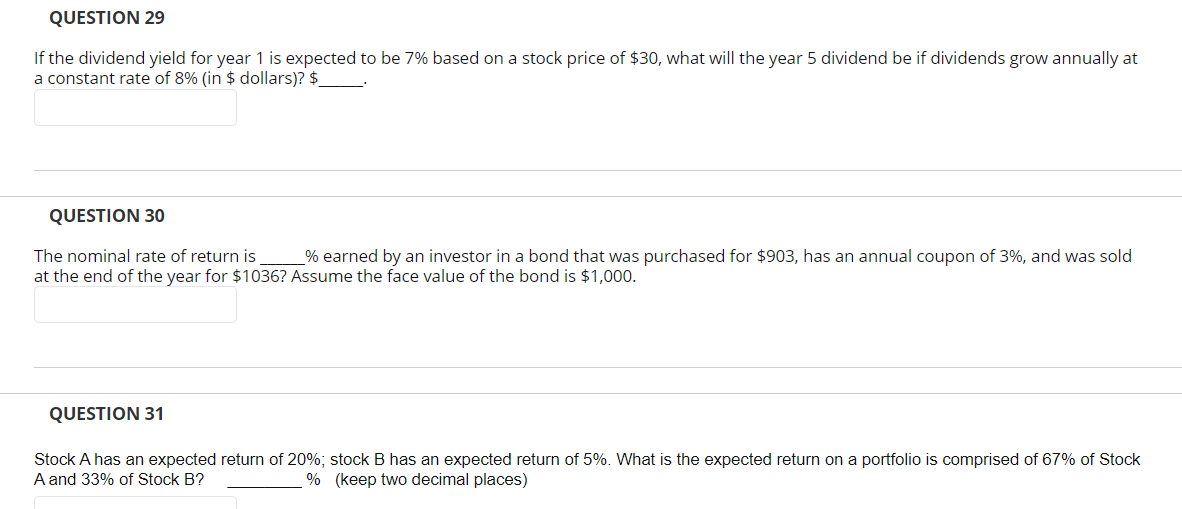

QUESTION 29 If the dividend yield for year 1 is expected to be 7% based on a stock price of $30, what will the year 5 dividend be if dividends grow annually at a constant rate of 8% (in $ dollars)? $_ QUESTION 30 The nominal rate of return is _% earned by an investor in a bond that was purchased for $903, has an annual coupon of 3%, and was sold at the end of the year for $1036? Assume the face value of the bond is $1,000. QUESTION 31 Stock A has an expected return of 20%; stock B has an expected return of 5%. What is the expected return on a portfolio is comprised of 67% of Stock A and 33% of Stock B? % (keep two decimal places) QUESTION 29 If the dividend yield for year 1 is expected to be 7% based on a stock price of $30, what will the year 5 dividend be if dividends grow annually at a constant rate of 8% (in $ dollars)? $__________ QUESTION 30 The nominal rate of return is_________% earned by an investor in a bond that was purchased for $903, has an annual coupon of 3%, and was sold at the end of the year for $1036? Assume the face value of the bond is $1,000. QUESTION 31 Stock A has an expected return of 20%; stock B has an expected return of 5%. What is the expected return on a portfolio is comprised of 67% of Stock A and 33% of Stock B? decimal places) % (keep two

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts