Question: please show the work involved with getting these answers Constant Growth Model (CGM): Annual dividends grew from $0.30 in 2010 to $0.99 in 2016. What

please show the work involved with getting these answers

please show the work involved with getting these answers

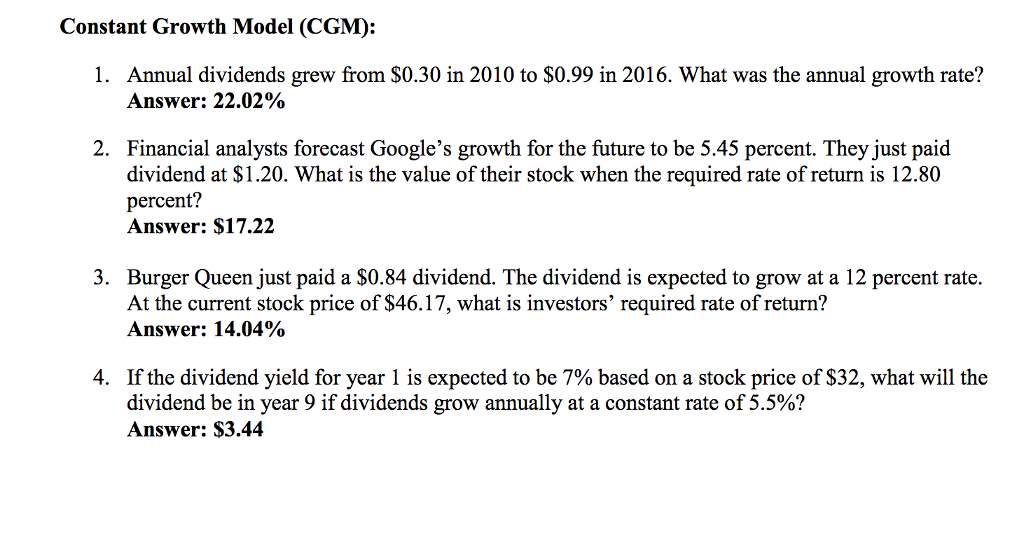

Constant Growth Model (CGM): Annual dividends grew from $0.30 in 2010 to $0.99 in 2016. What was the annual growth rate? Answer: 22.02% Financial analysts forecast Google's growth for the future to be 5.45 percent. They just paid dividend at $1.20. What is the value of their stock when the required rate of return is 12.80 percent? Answer: $17.22 Burger Queen just paid a $0.84 dividend. The dividend is expected to grow at a 12 percent rate. At the current stock price of $46.17, what is investors' required rate of return? Answer: 14.04% If the dividend yield for year 1 is expected to be 7% based on a stock price of $32, what will the dividend be in year 9 if dividends grow annually at a constant rate of 5.5%? Answer: $3.44

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts