Question: question 29 Lafferty Corporation is a specialty component manufacturer with idle capacity. Management would like to use its unused capacity to generate additional profits. A

question 29

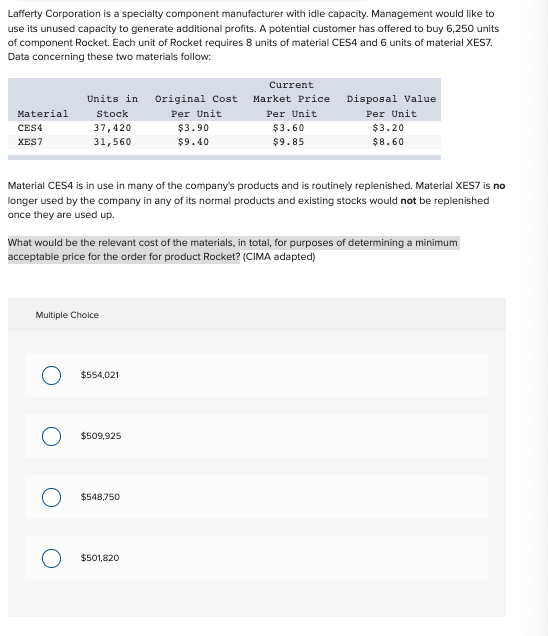

Lafferty Corporation is a specialty component manufacturer with idle capacity. Management would like to use its unused capacity to generate additional profits. A potential customer has offered to buy 6,250 units of component Rocket. Each unit of Rocket requires 8 units of material CES4 and 6 units of material XES7. Data concerning these two materials follow: Current Units in Original Cost Market Price Disposal Value Material Stock Per Unit Per Unit Per Unit CES4 37, 420 $3. 90 $3.60 $3.20 XEST 31, 560 $9.40 $9. 85 $8 . 60 Material CES4 is in use in many of the company's products and is routinely replenished. Material XES7 is no longer used by the company in any of its normal products and existing stocks would not be replenished once they are used up. What would be the relevant cost of the materials, in total, for purposes of determining a minimum acceptable price for the order for product Rocket? (CIMA adapted) Multiple Choice O $554,021 O $509,925 O $548,750 O $501,820

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts