Question: 2 2023_PGM4816_Assignment Cas X ( 2023_PGM4816 Assignment #1_1 x |+ X C File | C:/Users/201208412/AppData/Local/Temp/Tempcae55653-b009-430c-8419-16bfbd9f2939_PGM4816%20Case%20Study%20and%20Assignment%20Questions%20(1).zip/2023_PGM4816_Assignment%20Case%20Study_... > Cp ... b Draw & | | Read aloud

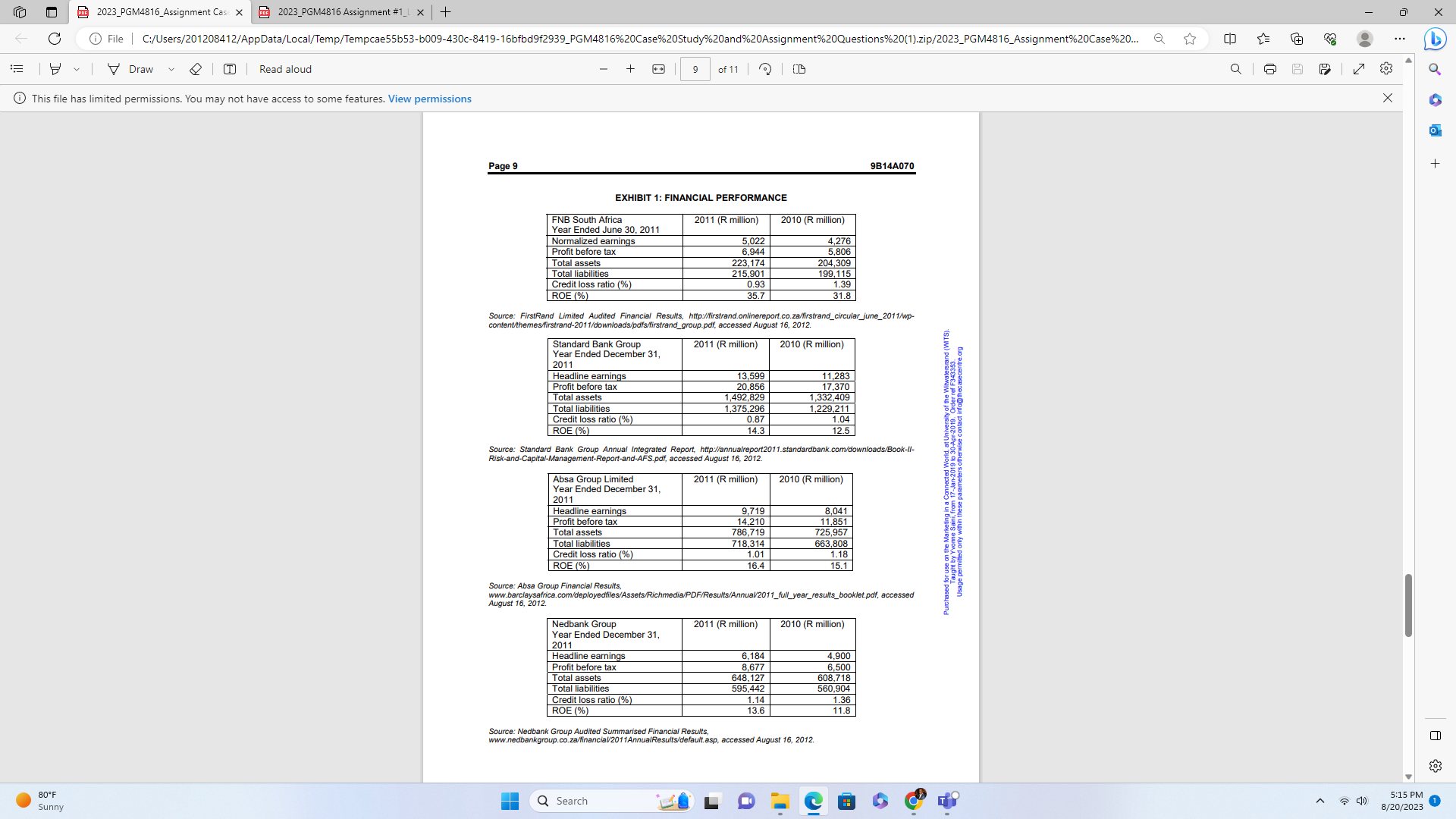

2 2023_PGM4816_Assignment Cas X ( 2023_PGM4816 Assignment #1_1 x |+ X C File | C:/Users/201208412/AppData/Local/Temp/Tempcae55653-b009-430c-8419-16bfbd9f2939_PGM4816%20Case%20Study%20and%20Assignment%20Questions%20(1).zip/2023_PGM4816_Assignment%20Case%20Study_... > Cp ... b Draw & | | Read aloud + 1 of 11 | 2 | 10 Q6897 503 This file has limited permissions. You may not have access to some features. View permissions X 9B14A070 + BANKING ON SOCIAL MEDIA (A) Luisa Mazinter, Nicola Kleyn, Michael M. Goldman and Jennifer Lindsey-Renton wrote this case solely to provide material for class discussion. The authors do not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized or otherwise reproduced in any form or by any means without the and (WITS) permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Westem University, London, Ontario, Canada, NG ON1; (t) 519.661.3208; (e) cases@ivey.ca; www.iveycases.com. Copyright @ 2015. Richard Ivey School of Business Version: 2015-01-28 sity of the Lana Strydom ended another productive team meeting on the third floor of First National Bank's Johannesburg headquarters on February 23, 2012, and headed back to her office to finish an e-mail she had been hoping to send upstairs before the end of the day. As head of digital marketing and media in the brand management unit at South Africa's First National Bank (FNB), Strydom had been responsible for the bank's social media marketing strategy since 2011. She was delighted that FNB had been acknowledged just a few days before as the top bank in terms of consumer attitude and perception in the 2012 BMI-TechKnowledge Digital Lifestyle predictor survey, perhaps partly due to the bank's well- publicized transactional banking app, which within 12 months had seen more than R5.2 billion (US$675 million)" in transactions. Strydom was excited about FNB's recent announcement offering banking via Facebook and numerous other innovations being worked on, but was also conscious of how rapidly the other major retail banks in South Africa were catching up. As Strydom returned to her e-mail, which was outlining the major challenges and opportunities facing ise on the FNB's social media heading into 2013, a tweet from @StandardBankGrp caught her attention. The $5 Twitter handle for Standard Bank, one of the three major retail banks that FNB competed against, stated Usage that it had just instructed its attorneys to lodge a complaint against what it alleged to be FNB's misleading advertising that laid claim to a number of innovations. Strydom wondered whether Standard Bank's use of Twitter to communicate this competitive action was related to FNB's extensive and well-publicized use of the micro-blogging service. She also knew that the debate on Twitter over the next few hours would be a significant indicator of whether her social media strategy had really been successful. ORIGINS OF FIRST NATIONAL BANK Claiming to be the oldest bank in South Africa, FNB traced its origins back to the Eastern Province Bank which was formed in Grahamstown in 1838. In 1891, the government decided to create a local commercial bank, which it did through a concession agreement. The task of The Nationale Bank der Zuid-Afrikaansche Republik Beperk (National Bank of the South African Republic Limited) was to focus primarily on financing agricultural development. After the end of Distributed by The North America Rest of the world www.thecasecentre.org t +1 781 239 5884 t +44 (0)1234 750903 case centre All rights reserved +1 781 239 5885 f +44 (0)1234 751125 e info.usa@thecasecentre.org e infogthecasecentre.org 80 F Q Search 5:14 PM Sunny 8/20/20232 2023_PGM4816_Assignment Cas X ( 2023_PGM4816 Assignment #1_1 x |+ X C File | C:/Users/201208412/AppData/Local/Temp/Tempcae55653-6009-430c-8419-16bfbd9f2939_PGM4816%20Case%20Study%20and%20Assignment%20Questions%20(1).zip/2023_PGM4816_Assignment%20Case%20Study_... > Cp ... b Draw & | | Read aloud + 2 of 11 | 2 | ED Q | 6 8 9 7 503 This file has limited permissions. You may not have access to some features. View permissions X Page 2 9614A070 the Second Anglo-Boer War, the name was changed to the National Bank of South Africa, which grew to one of the largest local banks by 1914." + However, by the early 1920s the National Bank was suffering from bad debt and heavy losses. It consequently merged with the Anglo-Egyptian Bank and the Colonial Bank in 1925 to form Barclays Bank (Dominion, Colonial and Overseas). In 1971, Barclays restructured its operations and its South African operation was renamed Barclays National Bank Limited." Due to a disinvestment campaign against South Africa because of its apartheid policies, Barclays sold its shareholding in the bank in 1986 and the bank was renamed First National Bank of Southern Africa Limited in 1987, becoming a wholly South African owned and controlled entity." A LANDMARK DEVELOPMENT and (WITS). FNB began a new chapter in 1998 when the financial services interests of Rand Merchant Bank Holdings and Anglo American were merged to form FirstRand Limited.' In the process, FNB was delisted from the casecentre. org Johannesburg Stock Exchange (JSE) on May 22, 1998, to become a wholly owned subsidiary of Witwale FirstRand, which was listed on the JSE on May 25, 1998. On June 30, 1999, the banking interests of FirstRand formally merged into a single entity to form FirstRand Bank." The other divisions comprised WesBank, a self-proclaimed leader in asset-based finance solutions, and Rand Merchant Bank, which was erwise contact info@ the created in 1977 by entrepreneurs Paul Harris, Laurie Dippenaar and GT Ferreira as a niche structured finance house.' Almost two centuries after its humble beginnings in Grahamstown, FNB had become one of South Africa's "Big Four" banks, with Nedbank, Standard Bank and Absa making up the remaining three. As advances in technology pushed the banking sector into unchartered territory, it remained to be seen which of the banks would take the lead in the race to the top. FINANCIAL PERFORMANCE The interim results for the six months ending December 2011 seemed positive for FNB, with pre-tax profits growing 30 per cent and producing a normalized return on equity (ROE) of 38 per cent. The credit for achieving the strategy to grow customers (over 5 per cent) and transactional volumes (over 10 per Usage pe cent) was given to the staff and its ability to create and implement innovative products as well as grow diverse channels to market. Costs, however, had grown 10 per cent over the period. (See Exhibit 1.) The advertising costs to drive the growth of the FNB brand had come with a price tag of R370 million in 2011, of which 10 per cent had been used for digital marketing and to build and manage its online social networks. In commenting to the media on the costs for the period, FNB's CEO, Michael Jordan, claimed that the ongoing investment in the business, such as the rollout of the EasyPlan infrastructure, innovative mobile platforms and customer acquisition strategies, had been a worthwhile investment. While cost reduction was considered an area for focus, investment was forecast to continue in areas of the business where growth opportunities existed, particularly through the use of innovative products and reward programs which had driven good growth in customer and transactional volumes in the consumer segment." It was also expected that a bigger percentage of total advertising spending would go to digital marketing in 2012. 80 F Sunny Q Search 5:14 PM 8/20/20232 2023_PGM4816_Assignment Cas X ( 2023_PGM4816 Assignment #1_1 x |+ X C File | C:/Users/201208412/AppData/Local/Temp/Tempcae55653-b009-430c-8419-16bfbd9f2939_PGM48 16%20Case%20Study%20and%20Assignment%20Questions%20(1).zip/2023_PGM4816_Assignment%20Case%20... ... b Draw & | | Read aloud + 3 of 11 | 2 | ED 503 This file has limited permissions. You may not have access to some features. View permissions X Page 3 9B14A070 + With professional services firm PricewaterhouseCoopers predicting a less-than-rosy revenue outlook for the banking industry in South Africa in its Major Banks Analysis Survey of 2011, the leadership team at FNB realized that there would be at least six separate sources of pressure on revenue in the near term: Margin pressures as historically low interest rates were maintained. . Low growth in credit, given the strength of economic activity in general. . An increased cost of funding, as banks' funding profiles were lengthened, with no reprieve on the cost of retail funding through deposits. . Subdued trading income. Pressure on fee income." Competitive activity and pressure from major players, as well as new entrants to the market. One of the areas that the team decided to place an increased focus on was pushing the mobile handset revolution, which it still saw as a potentially high-growth area that would not require significant ales rand (WITS) infrastructure investment and would provide access to digital banking services at a more affordable cost ecentre. org to the consumer. or ref F343353 By June 2012, the most recent : All Media & Products Survey (AMPS) 2011A/2012A showed that the bank's focus on online banking was paying off, with nearly 30 per cent of all online banking customers in ontact infor tec South Africa using FNB's online product. In addition, mobile banking was also proving to be a high- volume transactional channel, with AMPS 2011A/2012A highlighting that FNB had captured the largest market share in the country at 33 per cent." ected World at RETAIL BANKING IN SOUTH AFRICA Out of an estimated population of 50.59 million South Africans, "the "Big Four" claimed to have 34.5 wrin inese parameters of million accounts open between them, with an estimated 40 million open across all the banks countrywide. 12 he Marketing oat By early 2012, however, FNB found itself in an increasingly competitive sector. Apart from FNB's rivals in the "Big Four" category, young upstarts in the form of Capitec Bank and African Bank were making their presence felt - particularly in the previously unbanked market. A 2011 peer review amongst 20 banks in South Africa found that Standard Bank was leading the race in corporate banking, foreign exchange trading, fixed income, money markets and trade finance, amongst others, while Absa had yet Purchased to again positioned itself as the leader in retail lending and deposits, and home loans. FNB had, however, outdone Standard Bank to take the lead in Internet banking, which was a testament to the bank's focus on the digital arena."3 EXPANSION INTO AFRICA AND OTHER EMERGING MARKETS Priding itself on innovation and a willingness to venture further afield, First National Bank maintained banking subsidiaries which it owned wholly or in part, in Botswana, Mozambique, Namibia, South Africa, Swaziland, Tanzania, Zambia and India. Despite the ongoing recession, FNB continued to explore alternative options for expansion. Of the "Big Four," Standard Bank had the largest footprint in Africa covering 18 countries, with plans for further expansion into sub-Saharan Africa through the creation of an additional 30 branches in 2012." Nedbank and Absa, in the meantime, relied on alliances and partnerships to take advantage of growth opportunities on the continent." 80 F Sunny Q Search 5:14 PM 8/20/20232 2023_PGM4816_Assignment Cas X ( 2023_PGM4816 Assignment #1_1 x |+ X C File | C:/Users/201208412/AppData/Local/Temp/Tempcae55653-b009-430c-8419-16bfbd9f2939_PGM48 16%20Case%20Study%20and%20Assignment%20Questions%20(1).zip/2023_PGM4816_Assignment%20Case%20.. ... b Draw & | | Read aloud + | 4 of 11 | 2 | ED 503 This file has limited permissions. You may not have access to some features. View permissions X Page 4 9B14A070 O THE REGULATORY ENVIRONMENT + Although the International Monetary Fund stated that South African regulators had shielded the banking sector from the Global Financial Crisis, there was still concern amongst some in the banking sector regarding the heavy regulatory environment in the country." Legislation that affected the banking industry included, amongst others, the Banks Act, the National Payment System Act, the Financial Intelligence Centre Act, the Financial Intermediary and Advisory Services Act, the National Credit Act, the Consumer Protection Act, the Home Loan and Mortgage Disclosure Act and the Competition Act." Banks also had to comply with the King Report on Corporate Governance, Basel II and the Financial Sector Charter, a transformation charter in line with Broad-Based Black Economic Empowerment Act, which was signed in 2003 for implementation in 2004. The participants (financial institutions) committed to "actively promoting a transformed, vibrant, and globally competitive financial sector that reflects the demographics of South Africa, and contributing to the establishment of an equitable society by effectively s and (WITS) providing accessible financial services to black people and by directing investment into targeted sectors of the economy." of F343353. Other key issues for the retail banks included expansion plans into Africa, technological challenges, for mec profitability and revenue growth, risk management, skills shortages, an evolving competitive landscape, city of the market dynamics and, most importantly for Michael Jordan and his leadership team, keeping abreast of contact int innovation.9 rid, at Uni THE COOL REVOLUTION In 2004, 48-year-old Michael Jordaan took over as CEO of FNB, after spending a number of years in different leadership positions within the FirstRand Group. Jordaan believed that the key to its success was in attracting the right type of people to the organization. ng in a Co As CEO, I actually have very little to do. It's completely over-estimated what I do. I create an environment where people can come up with these ideas and do well. We're blessed with people who can do that. The thing about being good with tech is that we can't be a staid old bank. Very few people want to work for those. They like cool, hi-tech kind of companies to work for and so all I can do Purchased to is create the environment and trust in the people to innovate." As a major investor in South African soccer, it did not come as a surprise to many when FNB announced its sponsorship of the 2010 FIFA World Cup to the tune of about R216 million (US$30 million). FNB was the first South African corporation to sign up officially as a national supporter of the tournament. Many corporations believed that innovation was the key, yet on becoming CEO, Jordaan took this mantra one step further. Speaking at the South African Innovation Summit in 2010, Jordaan explained FNB's attitude to innovation to the audience. "We take innovation very seriously in FNB - none of these innovations simply happen by chance. The leadership of FNB believes that innovation is a key business attitude that enables South African businesses to compete effectively in the global environment." As part of his drive for innovation, Jordaan decided to build and manage FNB's reputation by enabling everyone in the business to consistently deliver on its promise of "How can we help you?" Jordaan was extremely comfortable and active on social networks - particularly Twitter - on which he discussed 80 F Sunny Q Search 5:14 PM 8/20/20232 2023_PGM4816_Assignment Cas X ( 2023_PGM4816 Assignment #1_1 x|+ X C File | C:/Users/201208412/AppData/Local/Temp/Tempcae55653-b009-430c-8419-16bfbd9f2939_PGM4816%20Case%20Study%20and%20Assignment%20Questions%20(1).zip/2023_PGM4816_Assignment%20Case%20... ... b Draw & | | Read aloud + 5 of 11 | 2 | ED 503 This file has limited permissions. You may not have access to some features. View permissions X O + Page 5 9B14A070 topics ranging from wine farming to the state of the economy and cricket. He was also known for occasionally responding directly to customer complaints or compliments. Research undertaken by BRANDfog had shown the importance of this, with 78 per cent of survey respondents saying that CEO participation in social media leads to better communication, while 71 per cent said it leads to improved brand image and 64 per cent said it provides more transparency." In addition, FNB created an Innovators' Initiative Award, rewarding up to R15 million (US$2 million) per annum to employees for unique and trend-setting ideas that really had a business benefit. In particular, one area Jordaan focused on was using digital innovation to grow the bank's market, whether by enabling customers to do some transactions on Facebook, launching an educational series on YouTube, opening a dotFNB store or creating the first banking app in South Africa. FNB'S SOCIAL MEDIA STRATEGY Between FNB's first foray into the social media space in 2004 and Strydom's move to FNB in mid-2011, the number of Twitter users in South Africa had grown to 1.5 million, LinkedIn users had grown to 1.8 million and Facebook users had grown to 5.3 million (more than 10 per cent of the population ). For this reason, the digital team at FNB identified this as an area to extend its already dominant digital footprint over its competitors and the team grew from one to eight people in 18 months. Once the decision had n a Connected World, at university of the Witmates rand (WITS). been made to explore the social media space further, the next step was to establish what role this particular channel would play in its overall business and channel mix. within these parameters ofherwise contact info@ mecasecentre . org Strydom believed that social media offered the FNB brand the ability to build ongoing relationships with customers and potential customers that were not bound by the inherent restrictions of most other communication methods and channels. At a team meeting, Strydom explained that, The medium allows for high levels of engagement across various areas including marketing (awareness, information and discovery), sales (acquiring), support (education, feedback, advice and complaints) and transacting (social commerce and loyalty). Our program will aim to build sustainable relationships with our customers, which in turn will give us the ability to further tap into the social graph that connects people to each other. Purchased for This would then allow FNB to actively express its core brand value of "How can we help you?" with the intention to have the bank be represented as approachable, trustworthy, likable and technology-savvy. The additional benefit, thought Strydom, would be that it would be able to develop a deep understanding of its customers' needs and social behaviours, including lifestyle choices and interests. The competitive pressure around retail banking in South Africa in particular had increased significantly in the previous year. Ernst & Young's Global Consumer Banking Survey for 2012" highlighted that bank customers globally were becoming less loyal to their banks. In South Africa, customer attrition had increased from 24 per cent to 39 per cent in one year (a 62.5 per cent increase) and 70 per cent of customers who had switched banks were citing high fees or charges as the main factor, followed by poor branch experiences and a lack of personalized contact. In the context of extreme competition between the South African banks for customers and a share of non-interest revenue, the survey also found that going forward, 13 per cent of customers were planning to switch banks. 80 F Sunny Q Search 5:14 PM 8/20/20232 2023_PGM4816_Assignment Cas X ( 2023_PGM4816 Assignment #1_1 x |+ X C File | C:/Users/201208412/AppData/Local/Temp/Tempcae55653-b009-430c-8419-16bfbd9f2939_PGM4816%20Case%20Study%20and%20Assignment%20Questions%20(1).zip/2023_PGM4816_Assignment%20Case%20... ... b Draw & | | Read aloud + 5 of 11 | 2 | ED 503 This file has limited permissions. You may not have access to some features. View permissions X O + Page 5 9B14A070 topics ranging from wine farming to the state of the economy and cricket. He was also known for occasionally responding directly to customer complaints or compliments. Research undertaken by BRANDfog had shown the importance of this, with 78 per cent of survey respondents saying that CEO participation in social media leads to better communication, while 71 per cent said it leads to improved brand image and 64 per cent said it provides more transparency." In addition, FNB created an Innovators' Initiative Award, rewarding up to R15 million (US$2 million) per annum to employees for unique and trend-setting ideas that really had a business benefit. In particular, one area Jordaan focused on was using digital innovation to grow the bank's market, whether by enabling customers to do some transactions on Facebook, launching an educational series on YouTube, opening a dotFNB store or creating the first banking app in South Africa. FNB'S SOCIAL MEDIA STRATEGY Between FNB's first foray into the social media space in 2004 and Strydom's move to FNB in mid-2011, the number of Twitter users in South Africa had grown to 1.5 million, LinkedIn users had grown to 1.8 million and Facebook users had grown to 5.3 million (more than 10 per cent of the population ). For this reason, the digital team at FNB identified this as an area to extend its already dominant digital footprint over its competitors and the team grew from one to eight people in 18 months. Once the decision had n a Connected World, at university of the Witwaters rand (WITS). been made to explore the social media space further, the next step was to establish what role this particular channel would play in its overall business and channel mix. within these parameters offerwise contact info@ mecasecentre .org Strydom believed that social media offered the FNB brand the ability to build ongoing relationships with customers and potential customers that were not bound by the inherent restrictions of most other communication methods and channels. At a team meeting, Strydom explained that, The medium allows for high levels of engagement across various areas including marketing (awareness, information and discovery), sales (acquiring), support (education, feedback, advice and complaints) and transacting (social commerce and loyalty). Our program will aim to build sustainable relationships with our customers, which in turn will give us the ability to further tap into the social graph that connects people to each other. Purchased for This would then allow FNB to actively express its core brand value of "How can we help you?" with the intention to have the bank be represented as approachable, trustworthy, likable and technology-savvy. The additional benefit, thought Strydom, would be that it would be able to develop a deep understanding of its customers' needs and social behaviours, including lifestyle choices and interests. The competitive pressure around retail banking in South Africa in particular had increased significantly in the previous year. Ernst & Young's Global Consumer Banking Survey for 2012" highlighted that bank customers globally were becoming less loyal to their banks. In South Africa, customer attrition had increased from 24 per cent to 39 per cent in one year (a 62.5 per cent increase) and 70 per cent of customers who had switched banks were citing high fees or charges as the main factor, followed by poor branch experiences and a lack of personalized contact. In the context of extreme competition between the South African banks for customers and a share of non-interest revenue, the survey also found that going forward, 13 per cent of customers were planning to switch banks. 80 F Sunny Q Search 5:15 PM 8/20/20232 2023_PGM4816_Assignment Cas X ( 2023_PGM4816 Assignment #1_1 x |+ X C File | C:/Users/201208412/AppData/Local/Temp/Tempcae55653-b009-430c-8419-16bfbd9f2939_PGM4816%20Case%20Study%20and%20Assignment%20Questions%20(1).zip/2023_PGM4816_Assignment%20Case%20... ... b Draw & | | Read aloud | 6 of 11 | 2 | ED 503 This file has limited permissions. You may not have access to some features. View permissions X O Page 6 9B14A070 + As banks had also been placed under severe pressure to cut operational costs, of which the majority were situated in formal, physical infrastructure, most had begun to implement strategies to migrate those customers performing low-value, simple transactions to digital channels. One way in which Strydom had managed to drive consumers to an FNB product using a low-cost solution was with the creation of the eWallet Facebook game. In explaining her strategy, Strydom had explained that, "Although eWallet is a great product, our research is showing that there is a lack of understanding around how the product actually works. To that end, we would like to design a game with two objectives in mind: 1) create further market awareness around the benefits of the product, and 2) educate customers on how the product works." Upon being given the go-ahead, the team created a game that allowed users to interact with the actual product features to move from level to level, thus learning about the product in a fun and interactive way. More than 50,000 people visited the game and over 30,000 people actually played the game, many of whom came back repeatedly. The game contributed more than 100,000 new fans to the FNB Facebook page. More importantly, the game contributed 8,300 new senders and 30,000 new transactions to the ecentre.org eWallet product. Based purely on revenue, the net contribution to the business on a R1.4 million investment was R6.1 million. imversity of the Witsalesrand (WITS). However, as more banks started to embrace technology, there were fewer differentiators between the major players, with the result that Strydom realized the need for FNB to "conceptualize and implement strategies to mitigate the downward pressure on non-interest revenue." is offerwise contact info Strydom reminded her team that it needed to have "clever and effective strategies to replace lost fees, as well as to protect their remaining non-interest revenue." This, she explained, could involve a number of factors such as "innovative marketing campaigns to both attract new customers and retain existing customers, reducing service and transactional fees while increasing service levels, introducing loyalty schemes that reward customers who stay with the same provider, as well as a certain level of business diversification." She knew that applying strategic thought to how the bank engaged with stakeholders through social media was critical - both on an operational level and in achieving its long-term aims. As the team applied itself, however, it soon realized that it had created positive brand ambassadors who were recruiting customers on its behalf. In addition, it came to understand that many potential customers were using social media to research their choice of bank. Purchased for Fortunately for Strydom, the innovative culture that Jordaan had been cultivating meant that buy-in from the wider organization was achieved relatively easily. This meant that latitude was given when it came to implementing the social media strategy, giving the digital marketing team the opportunity to change things that did not work or expand things that did. In addition, formal service-level agreements were put in place with strategic business unit heads with regards to response times on social media complaints- regardless of what time of day or night they came through. Strydom encouraged her team to approach social media as a holistic channel rather than just as a marketing tool. One way in which she suggested his be done was to build value-added services such as Facebook banking onto the various platforms in an attempt to extend customer utility further than just marketing and customer support. The decision was made to create a singular social media presence, with the exception of specific sponsorship properties because they were managed in a very specific way. When discussing this strategy to her team, Strydom explained that, "We believe that a consolidated presence in the social media space allows us to build reach (which is important for all media), although we are aware that it comes at a loss 80 F Q Search 5:15 PM Sunny 8/20/20232 2023_PGM4816_Assignment Cas X ( 2023_PGM4816 Assignment #1_1 x|+ X C File | C:/Users/201208412/AppData/Local/Temp/Tempcae55653-b009-430c-8419-16bfbd9f2939_PGM4816%20Case%20Study%20and%20Assignment%20Questions%20(1).zip/2023_PGM4816_Assignment%20Case%20... ... b Draw & | | Read aloud + | 7 of 11 | 2 | ED 503 This file has limited permissions. You may not have access to some features. View permissions X Page 9B14A070 O of some relevance. This is a strategic decision we have made, as we believe it is more effective to create + and deliver content across fewer platforms and will allow us to focus on quality." Strydom decided to focus on Facebook and Twitter initially, later adding LinkedIn, as her research showed that these platforms were where the majority of the South African population was engaging. As FNB was a mass brand, she knew that the wider its reach the better, although the bank did target some of its communication at certain segments; for example, it used LinkedIn for professional communication around business banking rather than Facebook. The endeavour to humanize the brand led to the creation of RB Jacobs, a persona that could represent the bank in the social media environment on all its platforms. Going so far as to create a tone of voice and a visual representation for the persona, the name "RB Jacobs" was first used as a generic name on bank cards and cheque books, before being used by the digital team to become the name of the social media persona (see Exhibit 2). and (WITS). With every platform having its own plan, the team included elements such as when and how to activate the platform, identification of the capabilities provided by the platform, identification of how these capabilities supported the bank's business objectives, analysis of competitive activity, identification and ise contact infon mecasecentre . org creation of the visual branding elements required, building a communications plan that included marketing messages, and identifying and putting in place people and processes to support business objectives. These plans could then be adapted as feedback became available. Strydom's strategy also included the intention to extend customer interaction beyond information, marketing and customer service, into areas such as education, where video content could effectively be used for financial education and literacy. Some of these adaptations came about from the fact that FNB underestimated how quickly its or 17- Jan communities would grow, meaning that amongst other things, a constant revision of staff allocation became necessary. This was in part due to the expectation being set that the bank would respond to customers whenever they requested assistance, including weekends and public holidays. permitted only within these Strydom and Jordaan already knew that every social media platform was different, which meant that FNB had to align its interaction on each channel with its intent and mood. In addition, the social media team had to be aware of and in tune with all developments taking place within the company, including marketing campaigns, public relations launches, new product releases, product enhancements and system performance (uptime), and processes had to be in place to disseminate information in a timely fashion Usage from all areas of the business. This required a mind-shift across the organization, as the bank had to become more agile on various operational levels if it was to respond to the continuous flow of social media queries and complaints. As Strydom saw it, the only way to keep up with the volume was to constantly build systems and processes to provide better customer service through social media. Employing a team of social media writers from public relations, copywriting and similar backgrounds in a shift system from 6 a.m. until 10 p.m. seven days a week, including public holidays, meant that FNB was able to maintain an active voice in the community. One of the great benefits to the business was the ability to provide real-time feedback from customers, which was constantly shared with business units. Business units were provided with in-depth reporting on a monthly, as well as an ad hoc, basis. In addition, it was decided that these reports would be shared at an executive level in an effort to ensure that insights were turned into action. 80 F Q Search 5:15 PM Sunny 8/20/20232 2023_PGM4816_Assignment Cas X ( 2023_PGM4816 Assignment #1_1 x |+ X C File | C:/Users/201208412/AppData/Local/Temp/Tempcae55653-b009-430c-8419-16bfbd9f2939_PGM48 16%20Case%20Study%20and%20Assignment%20Questions%20(1).zip/2023_PGM4816_Assignment%20Case%20... ... b Draw & | | Read aloud + | 8 of 11 2 | ED 503 This file has limited permissions. You may not have access to some features. View permissions X O + Page 8 9B14A070 At the most recent executive committee meeting, Strydom had reported that on Facebook the organization was reaching between 50,000 and 100,000 active page engagements per month and that with a single post it was able to reach up to 1.4 million users. From a Twitter perspective, she added, FNB was reaching approximately 700,000 individual users per month. (See Exhibit 3) In an effort to extend its lead in social media, FNB was also starting to pull social media into other online content channels, by using platform-specific application programming interfaces (APIs) for integration, then building whatever business rules it required on top of the APIs. Strydom explained to the team that visual and audio brand recognition (reminders) would always remain important, and in fact they could become even more important in the future. "Brand stories that lead to trust and differentiation will most likely become even more important over time, as it will be almost impossible to differentiate on elements such as price, product and service. It is very difficult to tell a story using search only..." In line with this, FNB also ran an advertising campaign that was driven by the character "Steve." The calty of the ageaggrand (WITS). advertisements were used to personalize customers' commonly felt pain points in the category and positioned FNB as the solution, generating a substantial return on investment overall. According to be contact infon necasecentre. org FNB's Barrett Whiteford, "Within two months, this no-holds-barred approach to radio advertising resulted in more than 10,999 accounts opened (and cards swiped), resulting in increased uptake of other banking products on offer."As a personalization of the customer experience, Steve (who in effect represented competitive banking brands) was kept separate from the RB Jacobs persona, which represented FNB. Given the warning shot from Standard Bank, Strydom knew that it was time to reflect on their approach thus far. Strydom wondered what additional ideas were needed to allow FNB to not only continue differentiating itself, but also alleviate the pressure on non-interest revenues. ini, from 17-Jar ad only winin inese parameters of Luisa Mazinter is Adjunct Faculty at the University of Pretoria's Gordon Institute of Business Science. Nicola Kleyn is an the Marke Associate Professor at the University of Pretoria's Gordon Institute of Business Science. Michael M. Goldman is an Assistant Professor at the University of San Francisco and Adjunct F ty at the University of Pretoria's Gordon Institute of Business Science. Jennifer Lindsey-Renton is a freelance case writer for the University of Pretoria's Gordon Institute of Business Science. ge permit sed for us 80 F Sunny Q Search 5:15 PM 8/20/20232 2023_PGM4816_Assignment Cas X ( 2023_PGM4816 Assignment #1_1 x |+ X C File | C:/Users/201208412/AppData/Local/Temp/Tempcae55653-b009-430c-8419-16bfbd9f2939_PGM4816%20Case%20Study%20and%20Assignment%20Questions%20(1).zip/2023_PGM4816_Assignment%20Case%20... ... b Draw & | | Read aloud | 9 of 11 | 2 | ED 503 This file has limited permissions. You may not have access to some features. View permissions X O Page 9 9B14A070 + EXHIBIT 1: FINANCIAL PERFORMANCE FNB South Africa 2011 (R million) 2010 (R million) Year Ended June 30, 2011 Normalized earnings 5,022 4,276 Profit before tax 6,944 5,806 Total assets 23,174 04,309 Total liabilities 215,901 199,115 Credit loss ratio (%) 0.93 1.39 ROE (%) 35.7 31.8 Source: FirstRand Limited Audited Financial Results, http://firstrand.onlinereport.co.za/firstrand_circular_june_2011/wp- content/themes/firstrand-201 1/downloads/pdfs/firstrand_group.pdf, accessed August 16, 2012. Standard Bank Group 2011 (R million) 2010 (R million) and (WITS) Year Ended December 31, 2011 Headline earnings 13,599 11,283 Profit before tax 20,856 17,370 Total assets ,492,829 1,332,409 Total liabilities 1,375,296 1,229,211 Credit loss ratio (%) 0.87 1.04 contact in ROE (%) 14.3 12.5 ed World Aor 2019. Source: Standard Bank Group Annual Integrated Report, http://annualreport2011.standardbank.com/downloads/Book-ll- Risk-and-Capital-Management-Report-and-AFS.pdf, accessed August 16, 2012. Absa Group Limited 2011 (R million) 2010 (R million) Year Ended December 31, 2011 Headline earnings 9,719 8,041 Profit before tax 14,210 11,851 winin ine Total assets 86,719 25,957 Total liabilities 718,314 663,808 rmined only wi Credit loss ratio (%) 1.01 1.18 ROE (%) 16.4 15.1 Source: Absa Group Financial Results, Purchased for use w.barclaysafrica.com/deployedfiles/Assets/Richmedia/PDF/Results/Annual/2011_full_year_results_booklet.pdf, accessed August 16, 2012. Nedbank Group 2011 (R million) 2010 (R million) Year Ended December 31, 2011 Headline earnings 6,184 4,900 Profit before tax 8,677 6,500 Total assets 648,127 608,718 Total liabilities 595,442 560,904 Credit loss ratio (%) 1.14 1.36 ROE (%) 136 11.8 Source: Nedbank Group Audited Summarised Financial Results, www.nedbankgroup.co.za/financial/2011AnnualResults/default.asp, accessed August 16, 2012. 80 F Sunny Q Search 5:15 PM 8/20/20232 2023_PGM4816_Assignment Cas X ( 2023_PGM4816 Assignment #1_1 x |+ X C File | C:/Users/201208412/AppData/Local/Temp/Tempcae55653-b009-430c-8419-16bfbd9f2939_PGM4816%20Case%20Study%20and%20Assignment%20Questions%20(1).zip/2023_PGM4816_Assignment%20Case%20... ... b Draw & | | Read aloud + 10 of 11 | 2 | ED 503 This file has limited permissions. You may not have access to some features. View permissions X Page 10 9B14A070 O EXHIBIT 2: SOCIAL MEDIA PRESENCE OF FNB + RbJacobs (FNB Guy) Follow Abjacobs 35,563 Ter's How can I help your 2.115 FOLLOWS 12.054 FNB (First National Bank) Follow AbJacobs [FNB Guy) Tweets AM / No replies Be my friend! Ful ram THE, I'm the guy to speak to I'm just a tweet away! he wore photo Card delivered to you for free Apply online heres fro.co.za/cred HiJacobs [FNB Quy) are over the post 2 moresingleton awarded to Bushess doosum towergettin under 10 minutes crine. The Fit FNB he Marketing in a Connected World, at University of the Witwaters and (WAITS). misled only within inese parameters ofherwise contact info@ thecasecentre. org eWallet Money Magnet Game FNB FNB Like Message . sional Bank Bank/Financial Institution FNB is the most innovative bank in South Africa, and SHOPPING in Grahamstown in 1838. Today, FNB trades Purchased for us About toney Magnet INS AP NB Social Banking Source: Publicly available FNB Twitter and Facebook websites, retrieved August 16, 2012. EXHIBIT 3: SOCIAL MEDIA COMMUNITY SIZES ACROSS THE BIG FOUR BANKS (AS AT END OF FEBRUARY 2012) Bank Facebook I witter YouTube Linkedin FNB 53,545 6,250 (@RBJacobs) 125,315 4,603 Absa 53,331 23,220 3,29 Standard Bank 28,710 ,534 29,775 18,666 Nedbank 1.935 577 12,127 9.477 Source: E-mail from Suzanne Myburgh, Head: Digital Marketing & Media, FNB Brand Management, October 27, 2014. 80 F Sunny Q Search 5:15 PM 8/20/2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts