Question: Question 29 O pts The following problems must be solved algebraically, scanned or photographed, and uploaded to the exam in the NEXT QUESTION where you'll

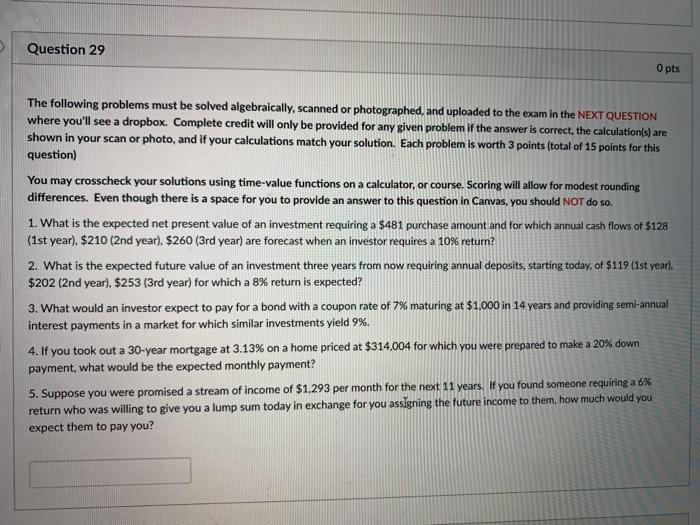

Question 29 O pts The following problems must be solved algebraically, scanned or photographed, and uploaded to the exam in the NEXT QUESTION where you'll see a dropbox. Complete credit will only be provided for any given problem if the answer is correct, the calculation(s) are shown in your scan or photo, and if your calculations match your solution. Each problem is worth 3 points (total of 15 points for this question) You may crosscheck your solutions using time-value functions on a calculator, or course. Scoring will allow for modest rounding differences. Even though there is a space for you to provide an answer to this question in Canvas, you should NOT do so. 1. What is the expected net present value of an investment requiring a $481 purchase amount and for which annual cash flows of $128 (1st year). $210 (2nd year), $260 (3rd year) are forecast when an investor requires a 10% return? 2. What is the expected future value of an investment three years from now requiring annual deposits, starting today, of $119 (1st year). $202 (2nd year), $253 (3rd year) for which a 8% return is expected? 3. What would an investor expect to pay for a bond with a coupon rate of 7% maturing at $1,000 in 14 years and providing semi-annual interest payments in a market for which similar investments yield 9%. 4. If you took out a 30-year mortgage at 3.13% on a home priced at $314,004 for which you were prepared to make a 20% down payment, what would be the expected monthly payment? 5. Suppose you were promised a stream of income of $1,293 per month for the next 11 years. If you found someone requiring a 6% return who was willing to give you a lump sum today in exchange for you assigning the future income to them, how much would you expect them to pay you

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts