Question: Question 29 You are considering two machines, A and B that can be used for the same purpose. Machine A costs $250,000, will reduce costs

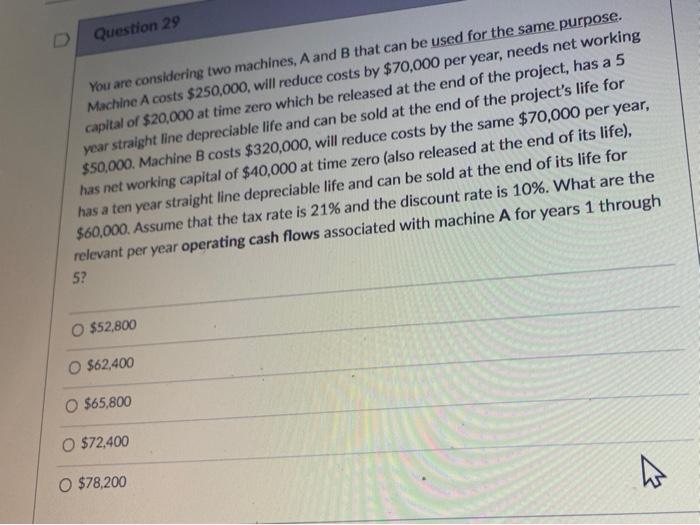

Question 29 You are considering two machines, A and B that can be used for the same purpose. Machine A costs $250,000, will reduce costs by $70,000 per year, needs net working capital of $20,000 at time zero which be released at the end of the project, has a 5 year straight line depreciable life and can be sold at the end of the project's life for $50,000, Machine B costs $320,000, will reduce costs by the same $70,000 per year, has net working capital of $40,000 at time zero (also released at the end of its life), has a ten year straight line depreciable life and can be sold at the end of its life for $60,000. Assume that the tax rate is 21% and the discount rate is 10%. What are the relevant per year operating cash flows associated with machine A for years 1 through 5? $52,800 O $62,400 O $65,800 $72,400 $78,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts