Question: Question 33 You are considering two machines, A and B that can be used for the same purpose. Machine A costs $250,000, will reduce costs

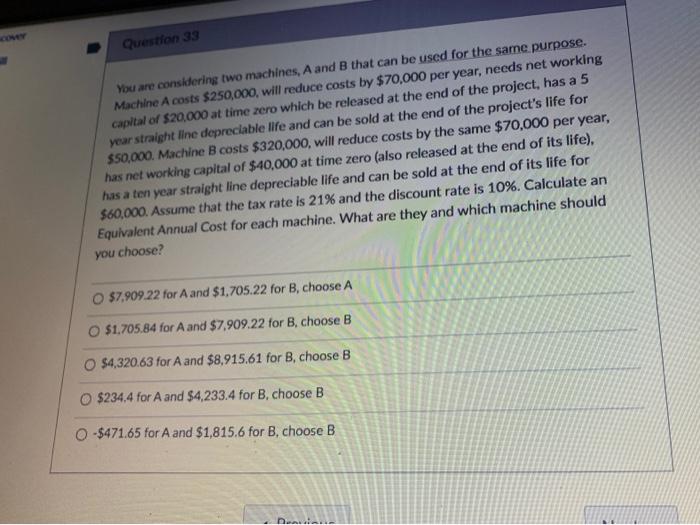

Question 33 You are considering two machines, A and B that can be used for the same purpose. Machine A costs $250,000, will reduce costs by $70,000 per year, needs net working capital of $20,000 at time zero which be released at the end of the project, has a 5 year straight line depreciable life and can be sold at the end of the project's life for $50,000. Machine B costs $320,000, will reduce costs by the same $70,000 per year, has net working capital of $40,000 at time zero (also released at the end of its life). has a ten year straight line depreciable life and can be sold at the end of its life for $60,000. Assume that the tax rate is 21% and the discount rate is 10%. Calculate an Equivalent Annual Cost for each machine. What are they and which machine should you choose? O $7,909.22 for A and $1,705.22 for B, choose A O $1.705.84 for A and $7,909.22 for B, choose B O $4,320.63 for A and $8,915.61 for B, choose B O $234.4 for A and $4,233.4 for B, choose B O-$471.65 for A and $1,815.6 for B, choose B nama

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts