Question: Question 2b [7 points) It's early March 2022 and the Commonwealth Serum Laboratories (CSL) has just started exporting COVID vaccines from its facilities in Melbourne

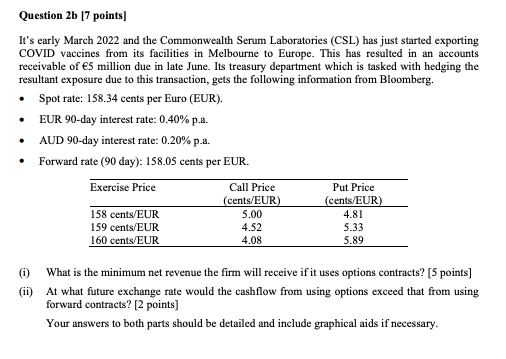

Question 2b [7 points) It's early March 2022 and the Commonwealth Serum Laboratories (CSL) has just started exporting COVID vaccines from its facilities in Melbourne to Europe. This has resulted in an accounts receivable of 5 million due in late June. Its treasury department which is tasked with hedging the resultant exposure due to this transaction, gets the following information from Bloomberg. Spot rate: 158.34 cents per Euro (EUR). EUR 90-day interest rate: 0.40%p.a. AUD 90-day interest rate: 0.20% p.a. Forward rate (90 day): 158.05 cents per EUR. Exercise Price 158 cents/EUR 159 cents/EUR 160 cents/EUR Call Price (cents/EUR) 5.00 4.52 4.08 Put Price (cents./EUR) 4.81 5.33 5.89 1) What is the minimum net revenue the firm will receive if it uses options contracts? [5 points] (ii) At what future exchange rate would the cashflow from using options exceed that from using forward contracts? [2 points) Your answers to both parts should be detailed and include graphical aids if necessary. Question 2b [7 points) It's early March 2022 and the Commonwealth Serum Laboratories (CSL) has just started exporting COVID vaccines from its facilities in Melbourne to Europe. This has resulted in an accounts receivable of 5 million due in late June. Its treasury department which is tasked with hedging the resultant exposure due to this transaction, gets the following information from Bloomberg. Spot rate: 158.34 cents per Euro (EUR). EUR 90-day interest rate: 0.40%p.a. AUD 90-day interest rate: 0.20% p.a. Forward rate (90 day): 158.05 cents per EUR. Exercise Price 158 cents/EUR 159 cents/EUR 160 cents/EUR Call Price (cents/EUR) 5.00 4.52 4.08 Put Price (cents./EUR) 4.81 5.33 5.89 1) What is the minimum net revenue the firm will receive if it uses options contracts? [5 points] (ii) At what future exchange rate would the cashflow from using options exceed that from using forward contracts? [2 points) Your answers to both parts should be detailed and include graphical aids if necessary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts