Question: QUESTION 2-FULL COSTING -Cont do it Pimlico Machining Limited has asked you to suggest a method of deducing the full cost of various production

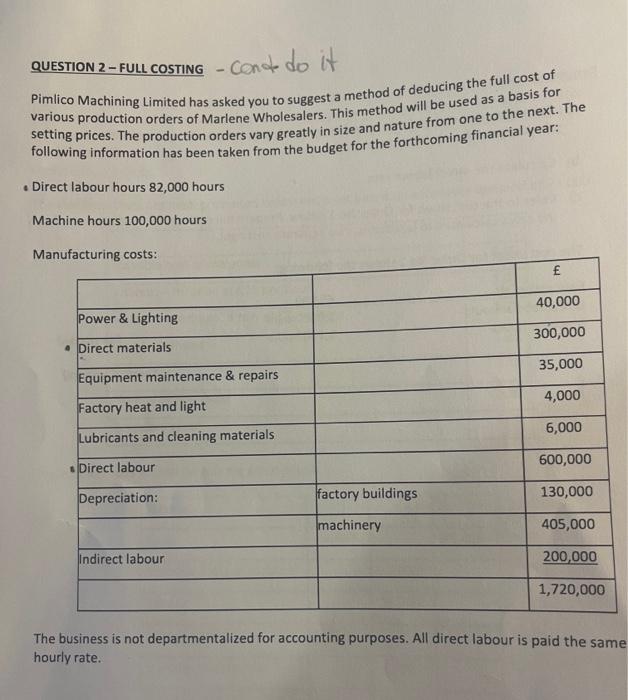

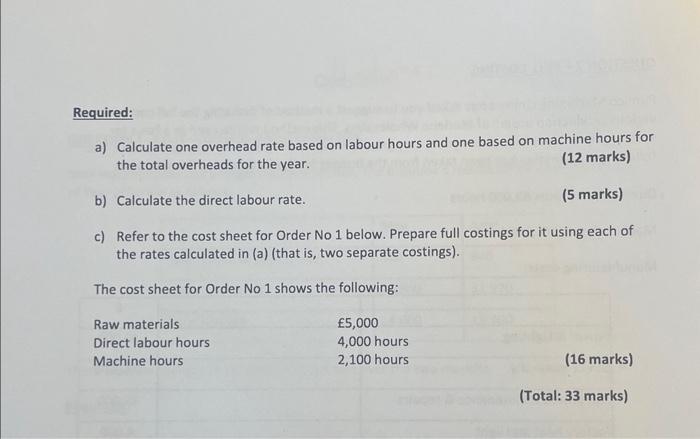

QUESTION 2-FULL COSTING -Cont do it Pimlico Machining Limited has asked you to suggest a method of deducing the full cost of various production orders of Marlene Wholesalers. This method will be used as a basis for setting prices. The production orders vary greatly in size and nature from one to the next. The following information has been taken from the budget for the forthcoming financial year: Direct labour hours 82,000 hours Machine hours 100,000 hours Manufacturing costs: Power & Lighting Direct materials Equipment maintenance & repairs Factory heat and light Lubricants and cleaning materials Direct labour Depreciation: Indirect labour 40,000 300,000 35,000 4,000 6,000 600,000 factory buildings 130,000 machinery 405,000 200,000 1,720,000 The business is not departmentalized for accounting purposes. All direct labour is paid the same hourly rate. Required: a) Calculate one overhead rate based on labour hours and one based on machine hours for the total overheads for the year. b) Calculate the direct labour rate. (12 marks) (5 marks) c) Refer to the cost sheet for Order No 1 below. Prepare full costings for it using each of the rates calculated in (a) (that is, two separate costings). The cost sheet for Order No 1 shows the following: Raw materials Direct labour hours Machine hours 5,000 4,000 hours 2,100 hours (16 marks) (Total: 33 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts