Question: Question 3 ( 1 3 points ) a ) Assume the risk - free rate is ( 8 % ) and the

Question points

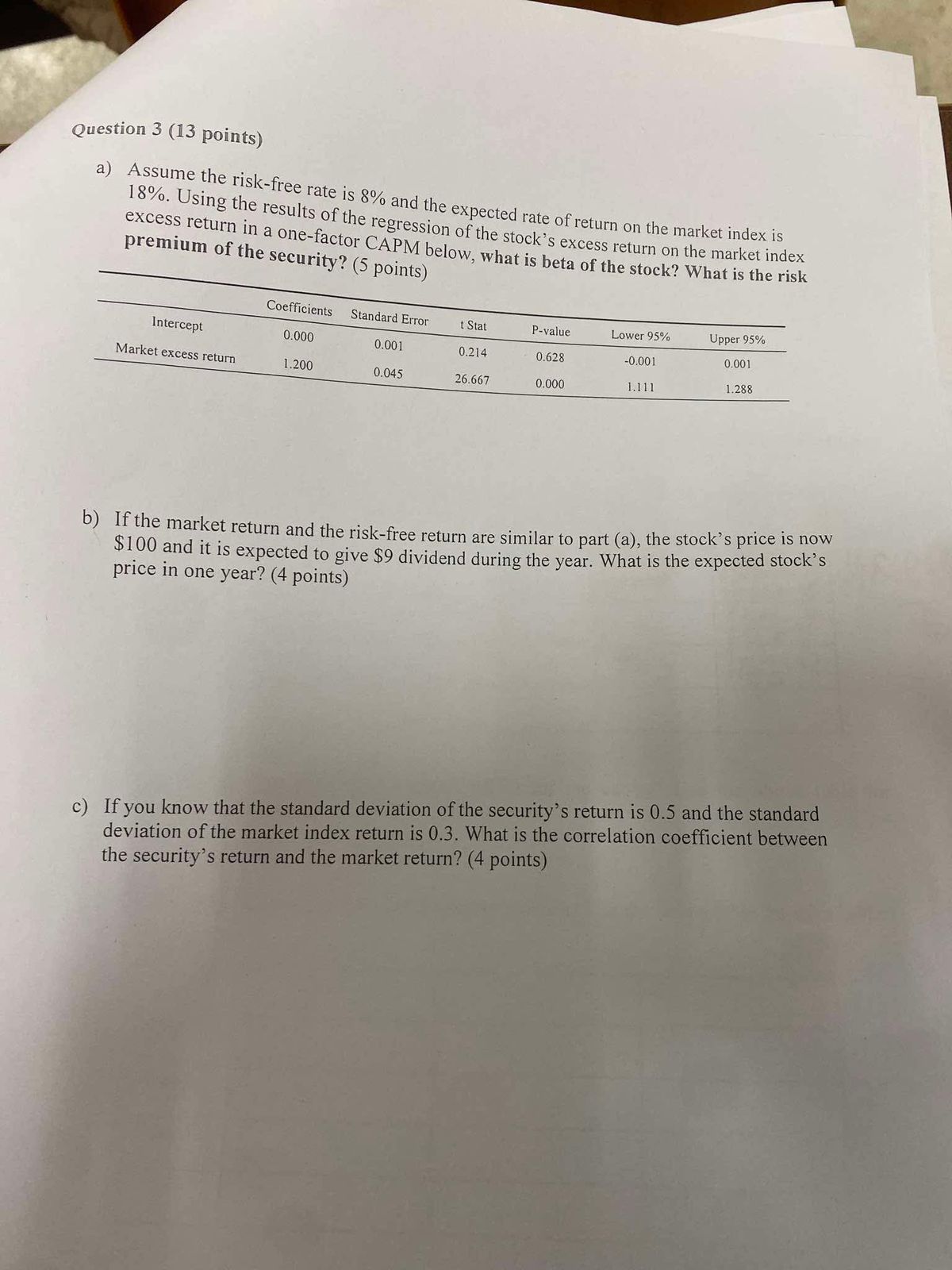

a Assume the riskfree rate is and the expected rate of return on the market index is Using the results of the regression of the stock's excess return on the market index excess return in a onefactor CAPM below, what is beta of the stock? What is the risk premium of the security? points

b If the market return and the riskfree return are similar to part a the stock's price is now $ and it is expected to give $ dividend during the year. What is the expected stock's price in one year? points

c If you know that the standard deviation of the securitys return is and the standard deviation of the market index return is What is the correlation coefficient between the securitys return and the market return? points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock