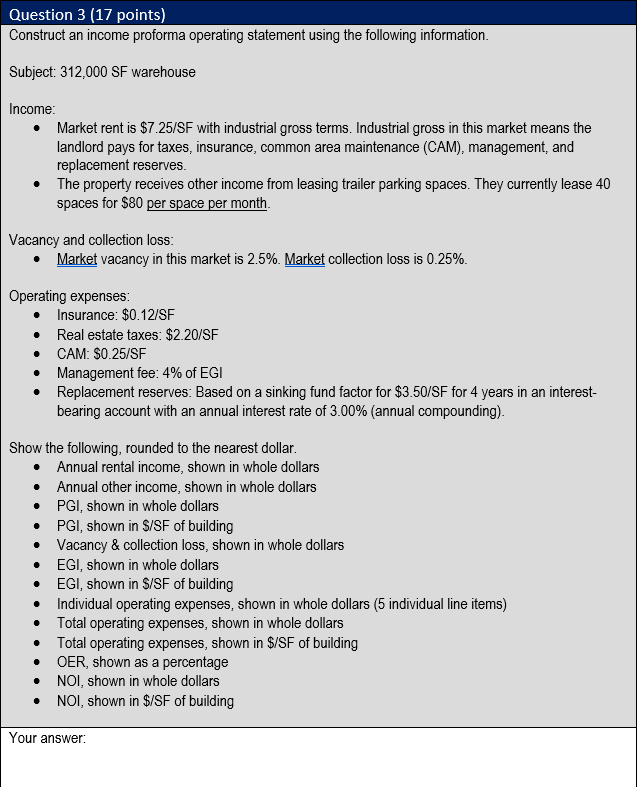

Question: Question 3 ( 1 7 points ) Construct an income proforma operating statement using the following information. Subject: 3 1 2 , 0 0 0

Question points

Construct an income proforma operating statement using the following information.

Subject: SF warehouse

Income:

Market rent is $SF with industrial gross terms. Industrial gross in this market means the landlord pays for taxes, insurance, common area maintenance CAM management, and replacement reserves.

The property receives other income from leasing trailer parking spaces. They currently lease spaces for $ per space per month.

Vacancy and collection loss:

Market vacancy in this market is Market collection loss is

Operating expenses:

Insurance: $SF

Real estate taxes: $SF

CAM: $SF

Management fee: of EGI

Replacement reserves: Based on a sinking fund factor for $SF for years in an interestbearing account with an annual interest rate of annual compounding

Show the following, rounded to the nearest dollar.

Annual rental income, shown in whole dollars

Annual other income, shown in whole dollars

PGI, shown in whole dollars

PGI, shown in $SF of building

Vacancy & collection loss, shown in whole dollars

EGI, shown in whole dollars

EGI, shown in $SF of building

Individual operating expenses, shown in whole dollars individual line items

Total operating expenses, shown in whole dollars

Total operating expenses, shown in $SF of building

OER, shown as a percentage

NOI, shown in whole dollars

NOI, shown in $SF of building

Question points

Construct an income proforma operating statement using the following information.

Subject: SF warehouse

Income:

Market rent is $ mathrmSF with industrial gross terms. Industrial gross in this market means the landlord pays for taxes, insurance, common area maintenance CAM management, and replacement reserves.

The property receives other income from leasing trailer parking spaces. They currently lease spaces for $ per space per month.

Vacancy and collection loss:

Market vacancy in this market is Market collection loss is

Operating expenses:

Insurance: $ mathrmSF

Real estate taxes: $ mathrmSF

CAM: $ mathrmSF

Management fee: of EGI

Replacement reserves: Based on a sinking fund factor for $ mathrmSF for years in an interestbearing account with an annual interest rate of annual compounding

Show the following, rounded to the nearest dollar.

Annual rental income, shown in whole dollars

Annual other income, shown in whole dollars

PGI, shown in whole dollars

PGI, shown in $ mathrmSF of building

Vacancy & collection loss, shown in whole dollars

EGI, shown in whole dollars

EGI, shown in $SF of building

Individual operating expenses, shown in whole dollars individual line items

Total operating expenses, shown in whole dollars

Total operating expenses, shown in $ mathrmSF of building

OER, shown as a percentage

NOI, shown in whole dollars

NOI shown in $ mathrmSF of building

Your answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock