Question: Question 3 (1 point) The Bank had incorrectly credited a company's account for $5,200 for a check in the amount of $520 deposited by the

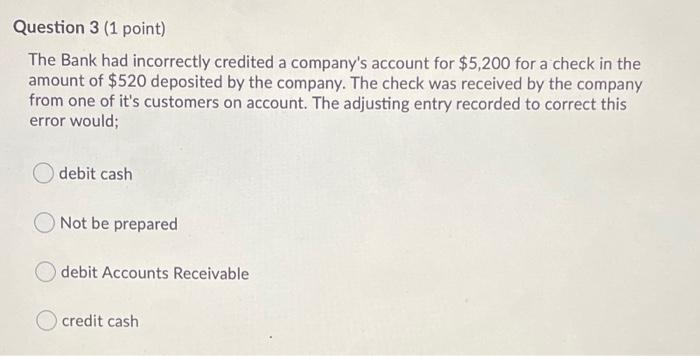

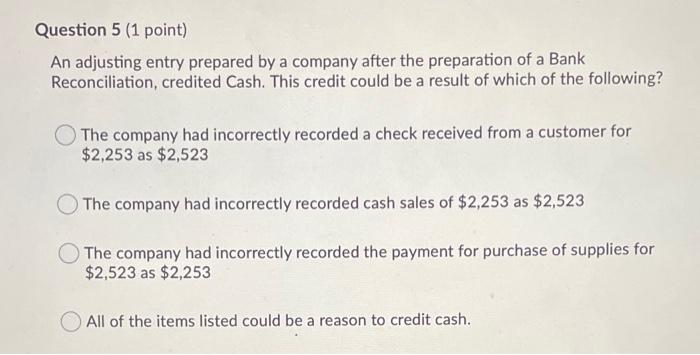

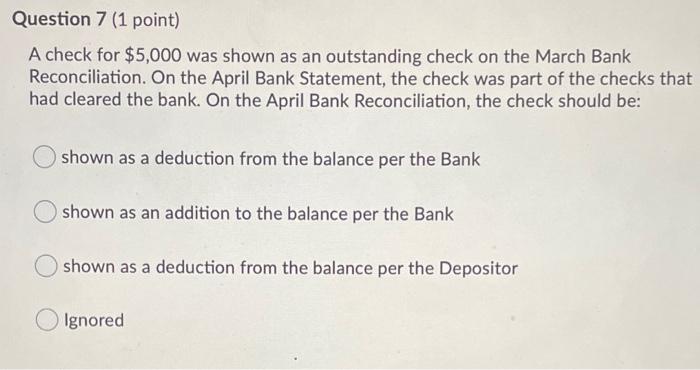

Question 3 (1 point) The Bank had incorrectly credited a company's account for $5,200 for a check in the amount of $520 deposited by the company. The check was received by the company from one of it's customers on account. The adjusting entry recorded to correct this error would; debit cash Not be prepared debit Accounts Receivable credit cash Question 5 (1 point) An adjusting entry prepared by a company after the preparation of a Bank Reconciliation, credited Cash. This credit could be a result of which of the following? The company had incorrectly recorded a check received from a customer for $2,253 as $2,523 The company had incorrectly recorded cash sales of $2,253 as $2,523 The company had incorrectly recorded the payment for purchase of supplies for $2,523 as $2,253 All of the items listed could be a reason to credit cash. Question 7 (1 point) A check for $5,000 was shown as an outstanding check on the March Bank Reconciliation. On the April Bank Statement, the check was part of the checks that had cleared the bank. On the April Bank Reconciliation, the check should be: shown as a deduction from the balance per the Bank shown as an addition to the balance per the Bank shown as a deduction from the balance per the Depositor Ignored

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts