Question: Question 3 1 pts Sand Key Development Company has a capital structure consisting of $20 million of 10% debt and $30 million of common equity.

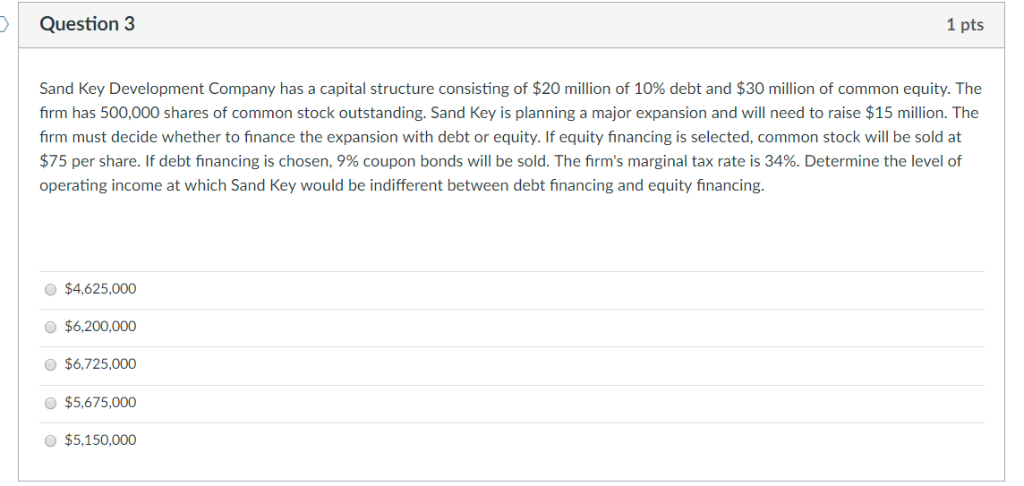

Question 3 1 pts Sand Key Development Company has a capital structure consisting of $20 million of 10% debt and $30 million of common equity. The firm has 500,000 shares of common stock outstanding. Sand Key is planning a major expansion and will need to raise $15 million. The firm must decide whether to finance the expansion with debt or equity. If equity financing is selected, common stock will be sold at $75 per share. If debt financing is chosen, 9% coupon bonds will be sold. The firm's marginal tax rate is 34%, Determine the level of operating income at which Sand Key would be indifferent between debt financing and equity financing. $4,625,000 $6,200,000 $6.725,000 $5,675,000 $5,150,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts