Question: Question 3 --/1 View Policies Current Attempt in Progress Garrett Boone, Blue Spruce Enterprises' vice president of operations, needs to replace an automatic lathe on

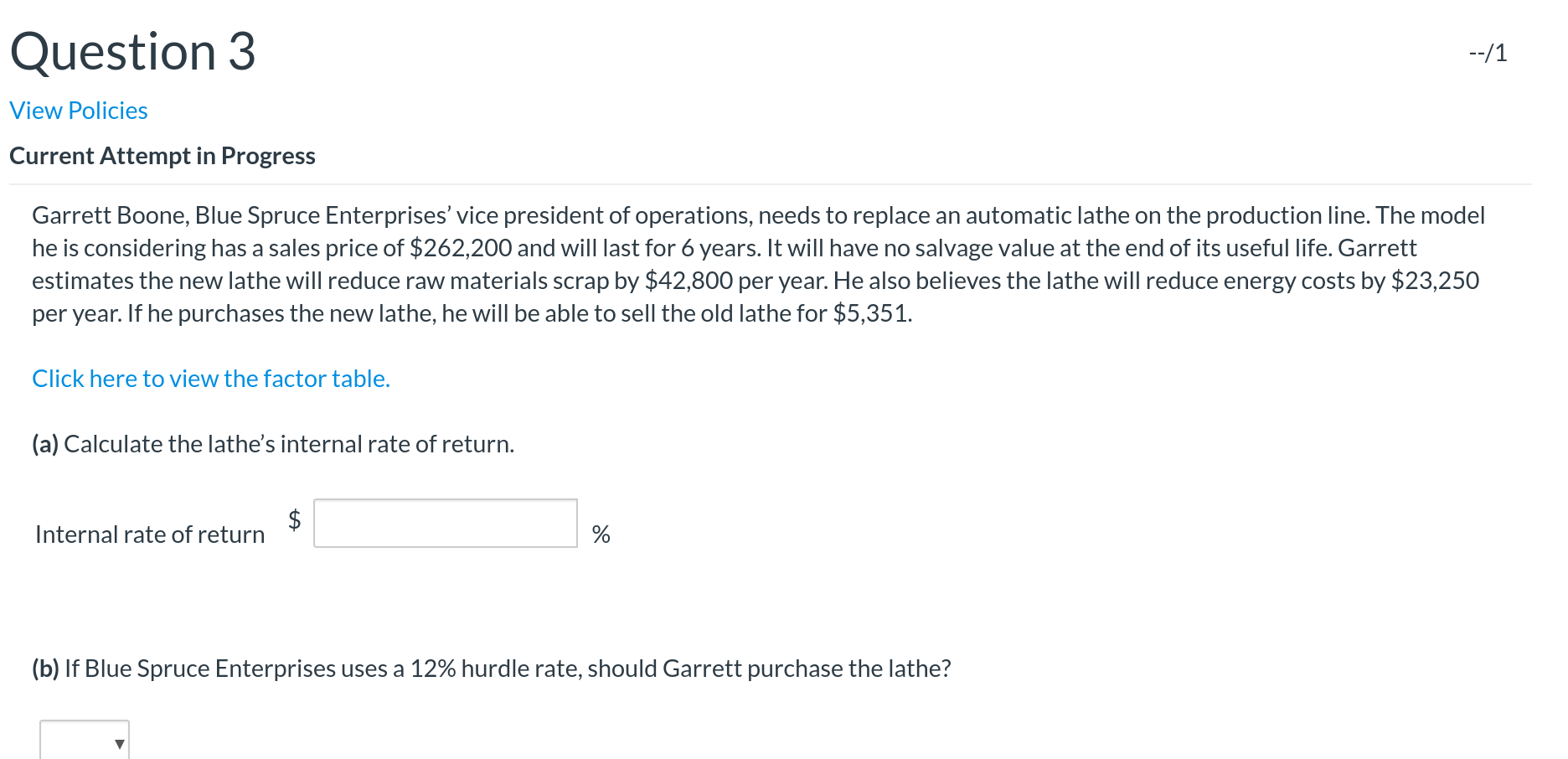

Question 3 --/1 View Policies Current Attempt in Progress Garrett Boone, Blue Spruce Enterprises' vice president of operations, needs to replace an automatic lathe on the production line. The model he is considering has a sales price of $262,200 and will last for 6 years. It will have no salvage value at the end of its useful life. Garrett estimates the new lathe will reduce raw materials scrap by $42,800 per year. He also believes the lathe will reduce energy costs by $23,250 per year. If he purchases the new lathe, he will be able to sell the old lathe for $5,351. Click here to view the factor table. (a) Calculate the lathe's internal rate of return. HA Internal rate of return (b) If Blue Spruce Enterprises uses a 12% hurdle rate, should Garrett purchase the lathe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts