Question: Question 3 (10 marks) a. An analyst is estimating the intrinsic value of the stock of Yipee Inc. The analyst estimates that the stock will

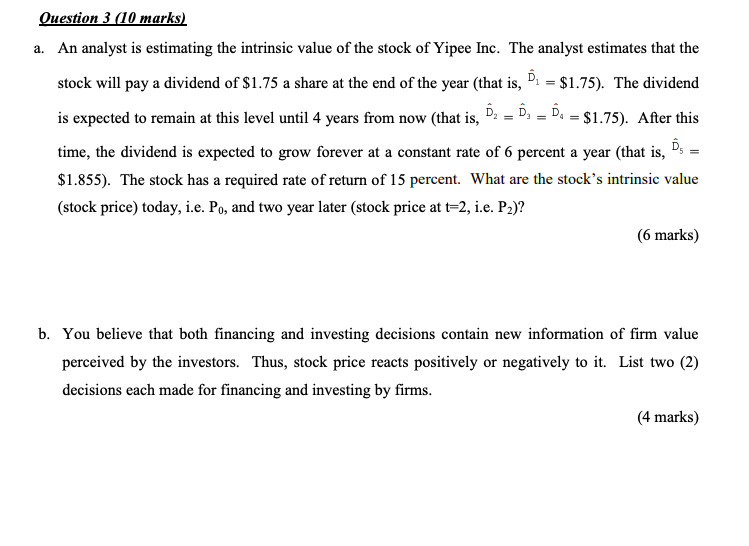

Question 3 (10 marks) a. An analyst is estimating the intrinsic value of the stock of Yipee Inc. The analyst estimates that the stock will pay a dividend of $1.75 a share at the end of the year (that is, D. = $1.75). The dividend is expected to remain at this level until 4 years from now (that is, D = D = D. - $1.75). After this time, the dividend is expected to grow forever at a constant rate of 6 percent a year (that is, Ds = $1.855). The stock has a required rate of return of 15 percent. What are the stock's intrinsic value (stock price) today, i.e. Po, and two year later (stock price at t-2, i.e. P2)? (6 marks) b. You believe that both financing and investing decisions contain new information of firm value perceived by the investors. Thus, stock price reacts positively or negatively to it. List two (2) decisions each made for financing and investing by firms. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts