Question: Question 3 (10 marks) a) Discuss duration. Include in your discussion what duration measures, how duration relates to maturity, what variables affect duration, and how

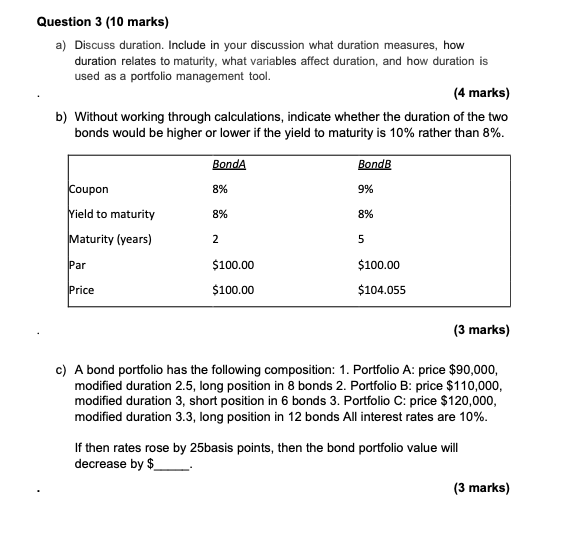

Question 3 (10 marks) a) Discuss duration. Include in your discussion what duration measures, how duration relates to maturity, what variables affect duration, and how duration is used as portfolio management tool. (4 marks) b) Without working through calculations, indicate whether the duration of the two bonds would be higher or lower if the yield to maturity is 10% rather than 8%. (3 marks) c) A bond portfolio has the following composition: 1. Portfolio A: price $90,000, modified duration 2.5, long position in 8 bonds 2. Portfolio B: price $110,000, modified duration 3, short position in 6 bonds 3 . Portfolio C: price $120,000, modified duration 3.3, long position in 12 bonds All interest rates are 10%. If then rates rose by 25 basis points, then the bond portfolio value will decrease by $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts