Question: Question 3 (10 points): Using the Modified Accelerated Cost Recovery method (table A-1), calculate the depreciation of $2,000,000 property for 7-year half-year convention. Note: no

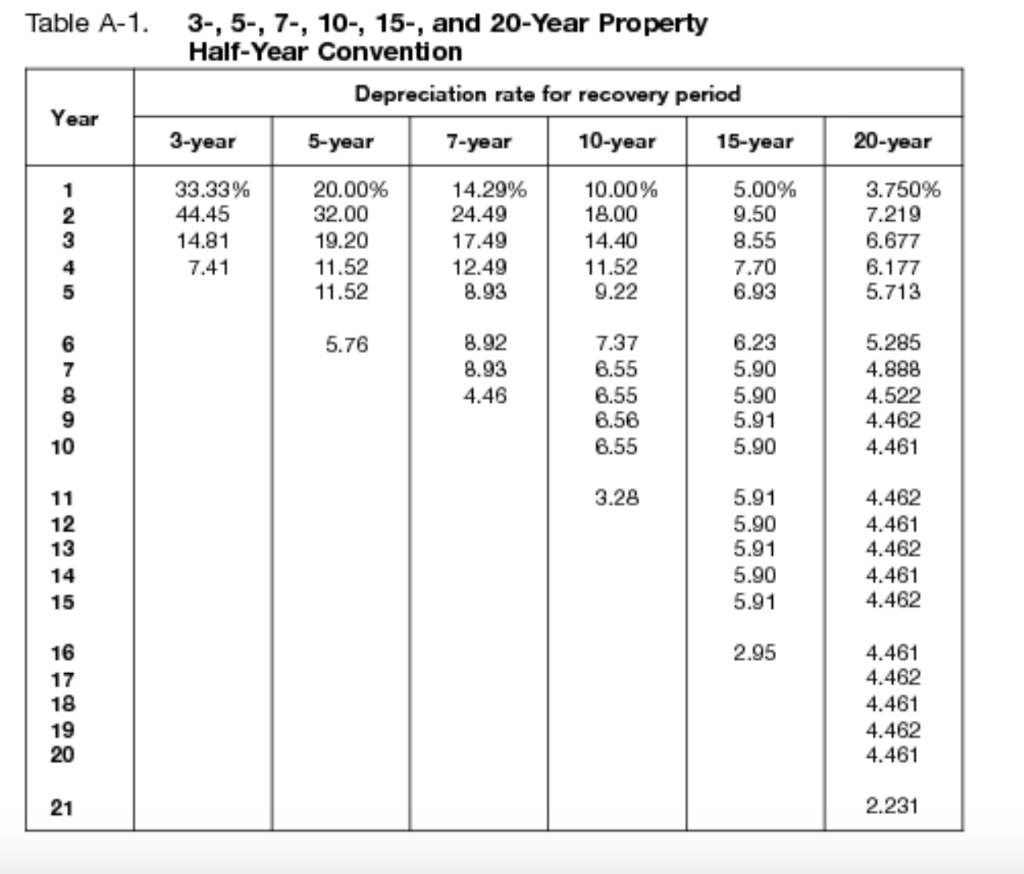

Question 3 (10 points): Using the Modified Accelerated Cost Recovery method (table A-1), calculate the depreciation of $2,000,000 property for 7-year half-year convention. Note: no need to calculate CF. Table A-1. Year 20-year 3-, 5-, 7-, 10-, 15-, and 20-Year Property Half-Year Convention Depreciation rate for recovery period 3-year 5-year 7-year 10-year 15-year 33.33% 20.00% 14.29% 10.00% 5.00% 44.45 32.00 24.49 18.00 9.50 19.20 17.49 14.40 8.55 7.41 11.52 12.49 11.52 7.70 11.52 8.93 9.22 6.93 14.81 3.750% 7.219 6.677 6.177 5.713 5.76 8.92 8.93 4.46 7.37 6.55 6.55 6.56 6.55 6.23 5.90 5.90 5.91 5.90 5.285 4.888 4.522 4.462 4.461 3.28 5.91 5.90 5.91 5.90 5.91 4.462 4.461 4.462 4.461 4.462 2.95 4.461 4.462 4.461 4.462 4.461 2.231

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts