Question: Question 3 (11 marks) A. RK Co purchased a machine on 1st November 2020 at the cost of $110,000 (inclusive of GST) and exclusively used

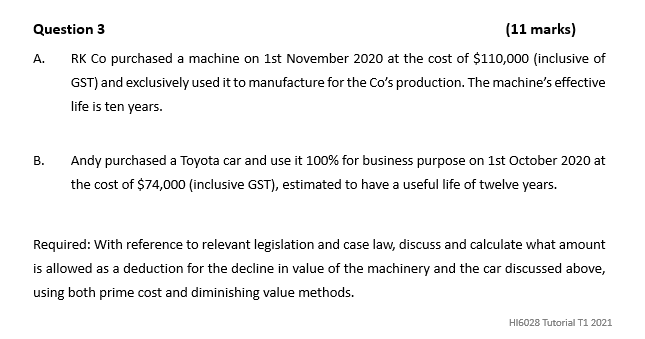

Question 3 (11 marks) A. RK Co purchased a machine on 1st November 2020 at the cost of $110,000 (inclusive of GST) and exclusively used it to manufacture for the Co's production. The machine's effective life is ten years. B. Andy purchased a Toyota car and use it 100% for business purpose on 1st October 2020 at the cost of $74,000 (inclusive GST), estimated to have a useful life of twelve years. Required: With reference to relevant legislation and case law, discuss and calculate what amount is allowed as a deduction for the decline in value of the machinery and the car discussed above, using both prime cost and diminishing value methods. H16028 Tutorial T1 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts