Question: Question 3 (11 marks) A. RK Co purchased a machine on 1st November 2020 at the cost of $110,000 (inclusive of GST) and exclusively used

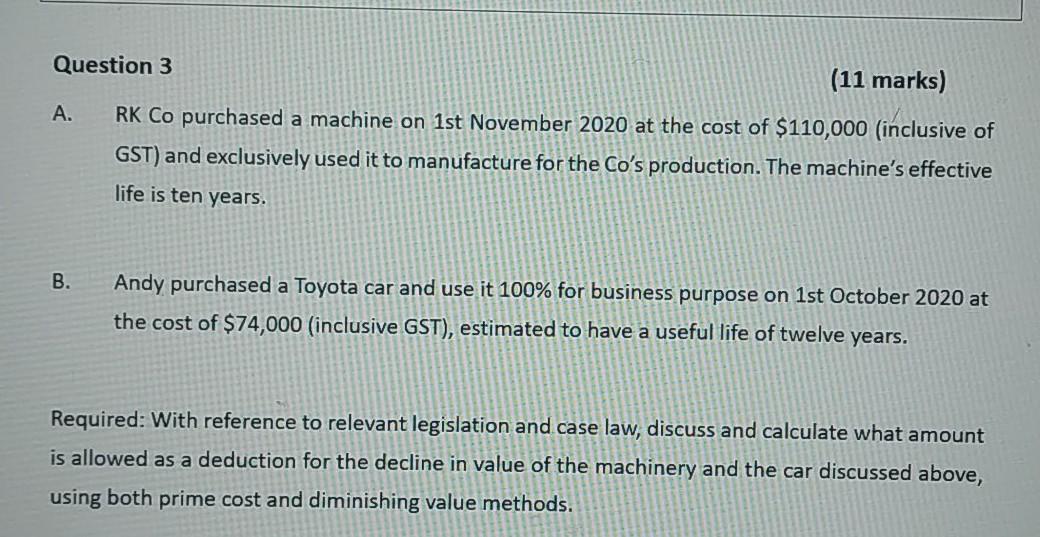

Question 3 (11 marks) A. RK Co purchased a machine on 1st November 2020 at the cost of $110,000 (inclusive of GST) and exclusively used it to manufacture for the Co's production. The machine's effective life is ten years. B. Andy purchased a Toyota car and use it 100% for business purpose on 1st October 2020 at the cost of $74,000 (inclusive GST), estimated to have a useful life of twelve years. Required: With reference to relevant legislation and case law, discuss and calculate what amount is allowed as a deduction for the decline in value of the machinery and the car discussed above, using both prime cost and diminishing value methods

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock