Question: Question 3: (16 points) B1, C1, C3 At the beginning of 2015 Fatema Company sold a land to Ramla Company at $50,000. The land originally

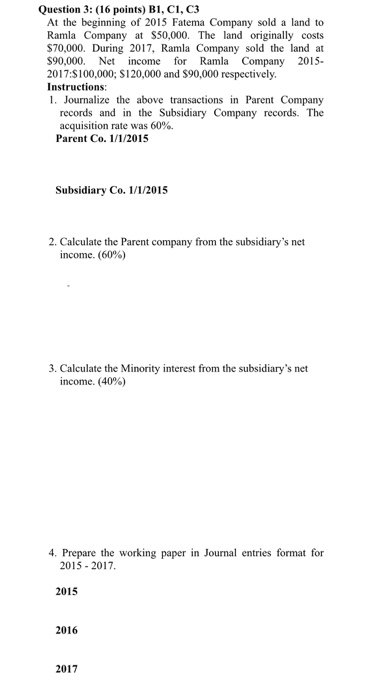

Question 3: (16 points) B1, C1, C3 At the beginning of 2015 Fatema Company sold a land to Ramla Company at $50,000. The land originally costs $70,000. During 2017, Ramla Company sold the land at $90,000. Net income for Ramla Company 2015- 2017:S100,000; S120,000 and $90,000 respectively. Instructions: 1. Journalize the above transactions in Parent Company records and in the Subsidiary Company records. The acquisition rate was 60%. Parent Co. 1/1/2015 Subsidiary Co. 1/1/2015 2. Calculate the Parent company from the subsidiary's net income. (60%) 3. Calculate the Minority interest from the subsidiary's net income. (40%) 4. Prepare the working paper in Journal entries format for 2015 - 2017. 2015 2016 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts