Question: QUESTION 3 ( 2 0 Marks ) REQUIRED Prepare the Statement of Financial Position as at 3 1 December 2 0 2 4 . Note:

QUESTION

Marks

REQUIRED

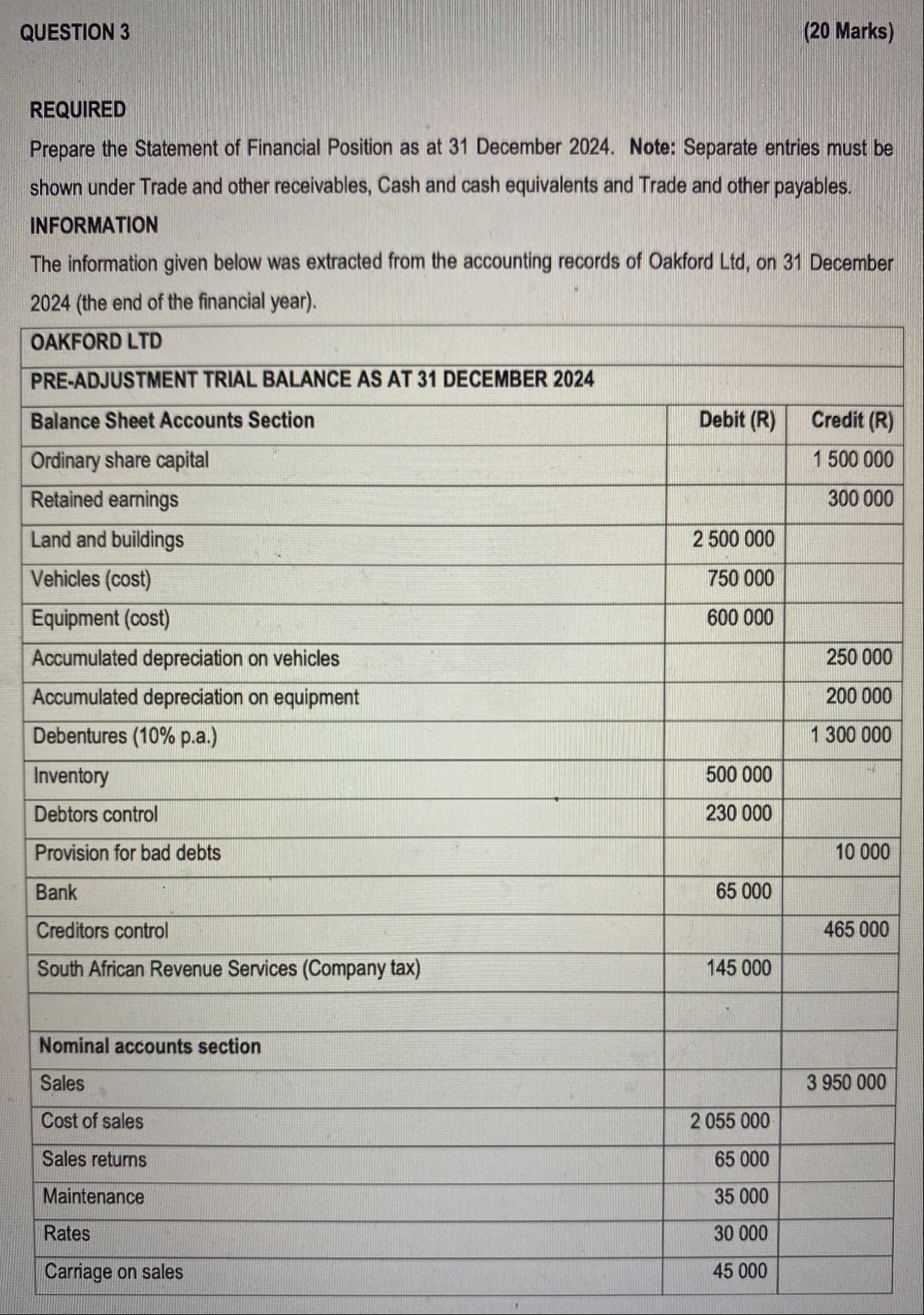

Prepare the Statement of Financial Position as at December Note: Separate entries must be shown under Trade and other receivables, Cash and cash equivalents and Trade and other payables.

INFORMATION

The information given below was extracted from the accounting records of Oakford Ltd on December the end of the financial year

tableOAKFORD LTDPREADJUSTMENT TRIAL BALANCE AS AT DECEMBER Balance Sheet Accounts Section,Debit RCredit ROrdinary share capital,,Retained earnings,,Land and buildings,Vehicles costEquipment costAccumulated depreciation on vehicles,,Accumulated depreciation on equipment,,Debentures paInventoryDebtors control,Provision for bad debts,,BankCreditors control,,South African Revenue Services Company taxNominal accounts section,,SalesCost of sales,Sales returns,MaintenanceRatesCarriage on sales,tableWages and salaries,StationeryBad debts,Sundry expenses,InsuranceTelephoneWater and electricity,Directors fees,Auditors fees,Ordinary share dividends,

Additional information

Stocktaking on December revealed the following inventories:

Trading inventory, R

Stationery, R

A notice from the municipality reflected the rates assessment for the year ended December to be R

Depreciation must be provided as follows:

On vehicles, R

On equipment, R

A debtor, who owed R was declared insolvent. His account must now be written off.

The insurance total includes an amount of R that was paid for the next accounting period.

An amount of R was due to be paid for audit fees on January

The provision for bad debts must be increased by R

Provide for interest on debentures for the year that is yet to be paid.

The company tax for the year amounted to R

The profit after tax for the financial year ended December was R after all the above information was considered.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock