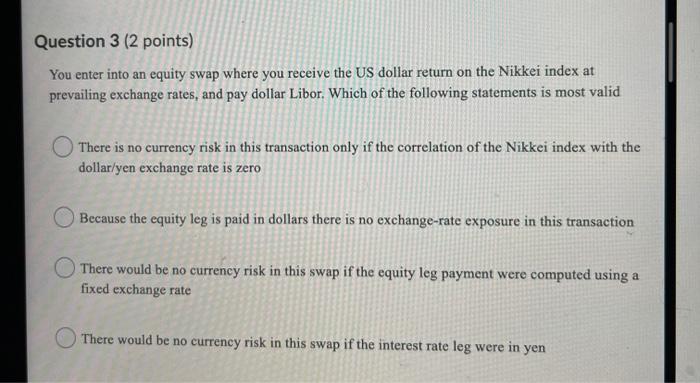

Question: Question 3 (2 points) You enter into an equity swap where you receive the US dollar return on the Nikkei index at prevailing exchange rates,

Question 3 (2 points) You enter into an equity swap where you receive the US dollar return on the Nikkei index at prevailing exchange rates, and pay dollar Libor. Which of the following statements is most valid There is no currency risk in this transaction only if the correlation of the Nikkei index with the dollar/yen exchange rate is zero Because the equity leg is paid in dollars there is no exchange-rate exposure in this transaction There would be no currency risk in this swap if the equity leg payment were computed using a fixed exchange rate There would be no currency risk in this swap if the interest rate leg were in yen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts