Question: QUESTION 3 (20 marks) (a) Assume the yield to maturity on a 10-year Australian government bond is 2 percent and the market risk premium is

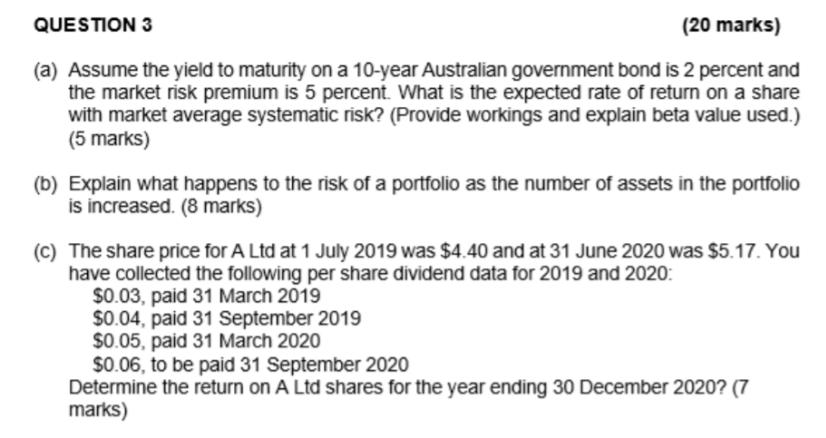

QUESTION 3 (20 marks) (a) Assume the yield to maturity on a 10-year Australian government bond is 2 percent and the market risk premium is 5 percent. What is the expected rate of return on a share with market average systematic risk? (Provide workings and explain beta value used.) (5 marks) (b) Explain what happens to the risk of a portfolio as the number of assets in the portfolio is increased. (8 marks) (c) The share price for A Ltd at 1 July 2019 was $4.40 and at 31 June 2020 was $5.17. You have collected the following per share dividend data for 2019 and 2020: $0.03, paid 31 March 2019 $0.04, paid 31 September 2019 $0.05, paid 31 March 2020 $0.06, to be paid 31 September 2020 Determine the return on A Ltd shares for the year ending 30 December 2020? (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts