Question: QUESTION 3 20 MARKS Hope Ltd has an equity beta of 1.10. The market risk premium in Namibia is expected to be 5% and the

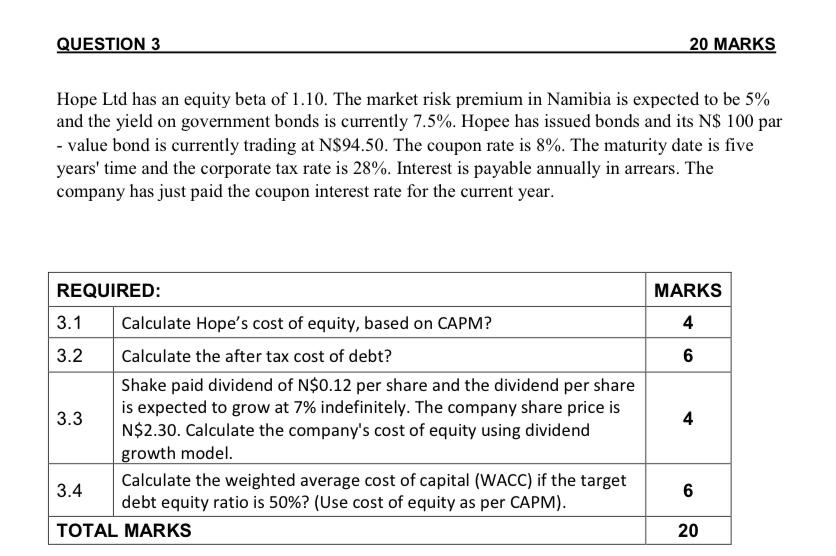

QUESTION 3 20 MARKS Hope Ltd has an equity beta of 1.10. The market risk premium in Namibia is expected to be 5% and the yield on government bonds is currently 7.5%. Hopee has issued bonds and its N$ 100 par - value bond is currently trading at N$94.50. The coupon rate is 8%. The maturity date is five years' time and the corporate tax rate is 28%. Interest is payable annually in arrears. The company has just paid the coupon interest rate for the current year. 3.1 MARKS 4 6 REQUIRED: Calculate Hope's cost of equity, based on CAPM? 3.2 Calculate the after tax cost of debt? Shake paid dividend of N$0.12 per share and the dividend per share is expected to grow at 7% indefinitely. The company share price is 3.3 N$2.30. Calculate the company's cost of equity using dividend growth model 3.4 Calculate the weighted average cost of capital (WACC) if the target debt equity ratio is 50%? (Use cost of equity as per CAPM). TOTAL MARKS 4 6 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts