Question: Question 3 (20 marks) John has bought a residential flat in Mong Kok at a price of $6 million. He has applied for a fully-amortizing

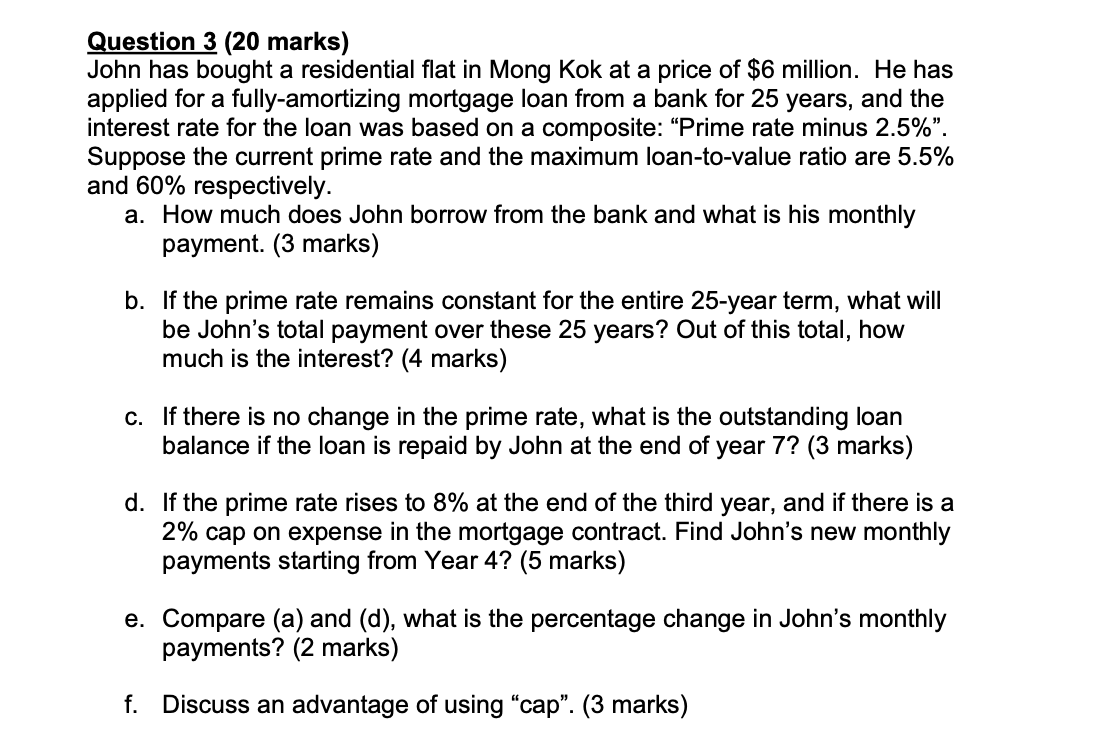

Question 3 (20 marks) John has bought a residential flat in Mong Kok at a price of $6 million. He has applied for a fully-amortizing mortgage loan from a bank for 25 years, and the interest rate for the loan was based on a composite: Prime rate minus 2.5%. Suppose the current prime rate and the maximum loan-to-value ratio are 5.5% and 60% respectively. a. How much does John borrow from the bank and what is his monthly payment. (3 marks) b. If the prime rate remains constant for the entire 25-year term, what will be John's total payment over these 25 years? Out of this total, how much is the interest? (4 marks) c. If there is no change in the prime rate, what is the outstanding loan balance if the loan is repaid by John at the end of year 7? (3 marks) d. If the prime rate rises to 8% at the end of the third year, and if there is a 2% cap on expense in the mortgage contract. Find John's new monthly payments starting from Year 4? (5 marks) e. Compare (a) and (d), what is the percentage change in John's monthly payments? (2 marks) f. Discuss an advantage of using "cap

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts