Question: Question 3 (20 Marks) Part A (5 Marks) Harry Ltd employ its staff on a five-day work a week, with employees being paid on Fridays.

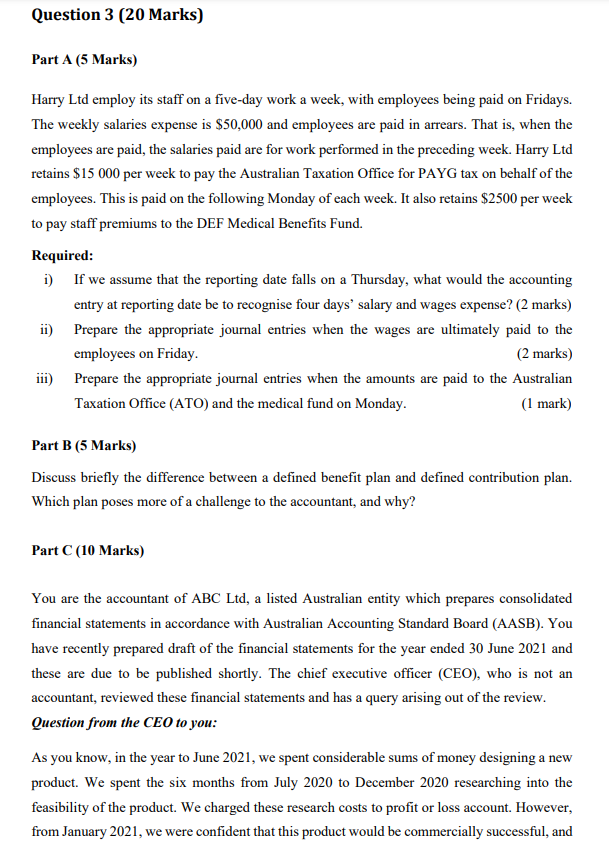

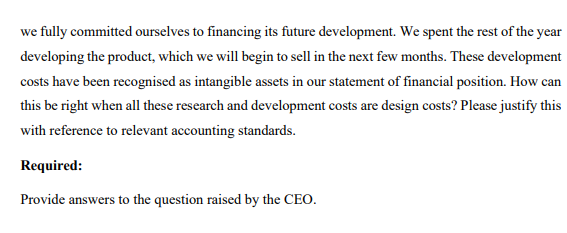

Question 3 (20 Marks) Part A (5 Marks) Harry Ltd employ its staff on a five-day work a week, with employees being paid on Fridays. The weekly salaries expense is $50,000 and employees are paid in arrears. That is, when the employees are paid, the salaries paid are for work performed in the preceding week. Harry Ltd retains $15 000 per week to pay the Australian Taxation Office for PAYG tax on behalf of the employees. This is paid on the following Monday of each week. It also retains $2500 per week to pay staff premiums to the DEF Medical Benefits Fund. Required: i) If we assume that the reporting date falls on a Thursday, what would the accounting entry at reporting date be to recognise four days' salary and wages expense? (2 marks) ii) Prepare the appropriate journal entries when the wages are ultimately paid to the employees on Friday. (2 marks) iii) Prepare the appropriate journal entries when the amounts are paid to the Australian Taxation Office (ATO) and the medical fund on Monday. (1 mark) Part B (5 Marks) Discuss briefly the difference between a defined benefit plan and defined contribution plan. Which plan poses more of a challenge to the accountant, and why? Part C (10 Marks) You are the accountant of ABC Ltd, a listed Australian entity which prepares consolidated financial statements in accordance with Australian Accounting Standard Board (AASB). You have recently prepared draft of the financial statements for the year ended 30 June 2021 and these are due to be published shortly. The chief executive officer (CEO), who is not an accountant, reviewed these financial statements and has a query arising out of the review. Question from the CEO to you: As you know, in the year to June 2021, we spent considerable sums of money designing a new product. We spent the six months from July 2020 to December 2020 researching into the feasibility of the product. We charged these research costs to profit or loss account. However, from January 2021, we were confident that this product would be commercially successful, and we fully committed ourselves to financing its future development. We spent the rest of the year developing the product, which we will begin to sell in the next few months. These development costs have been recognised as intangible assets in our statement of financial position. How can this be right when all these research and development costs are design costs? Please justify this with reference to relevant accounting standards. Required: Provide answers to the question raised by the CEO. Question 3 (20 Marks) Part A (5 Marks) Harry Ltd employ its staff on a five-day work a week, with employees being paid on Fridays. The weekly salaries expense is $50,000 and employees are paid in arrears. That is, when the employees are paid, the salaries paid are for work performed in the preceding week. Harry Ltd retains $15 000 per week to pay the Australian Taxation Office for PAYG tax on behalf of the employees. This is paid on the following Monday of each week. It also retains $2500 per week to pay staff premiums to the DEF Medical Benefits Fund. Required: i) If we assume that the reporting date falls on a Thursday, what would the accounting entry at reporting date be to recognise four days' salary and wages expense? (2 marks) ii) Prepare the appropriate journal entries when the wages are ultimately paid to the employees on Friday. (2 marks) iii) Prepare the appropriate journal entries when the amounts are paid to the Australian Taxation Office (ATO) and the medical fund on Monday. (1 mark) Part B (5 Marks) Discuss briefly the difference between a defined benefit plan and defined contribution plan. Which plan poses more of a challenge to the accountant, and why? Part C (10 Marks) You are the accountant of ABC Ltd, a listed Australian entity which prepares consolidated financial statements in accordance with Australian Accounting Standard Board (AASB). You have recently prepared draft of the financial statements for the year ended 30 June 2021 and these are due to be published shortly. The chief executive officer (CEO), who is not an accountant, reviewed these financial statements and has a query arising out of the review. Question from the CEO to you: As you know, in the year to June 2021, we spent considerable sums of money designing a new product. We spent the six months from July 2020 to December 2020 researching into the feasibility of the product. We charged these research costs to profit or loss account. However, from January 2021, we were confident that this product would be commercially successful, and we fully committed ourselves to financing its future development. We spent the rest of the year developing the product, which we will begin to sell in the next few months. These development costs have been recognised as intangible assets in our statement of financial position. How can this be right when all these research and development costs are design costs? Please justify this with reference to relevant accounting standards. Required: Provide answers to the question raised by the CEO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts