Question: Question 3 20 marks Part A DEF Ltd is considering investing in a new project codenamed Project Lion. The project is expected to generate cash

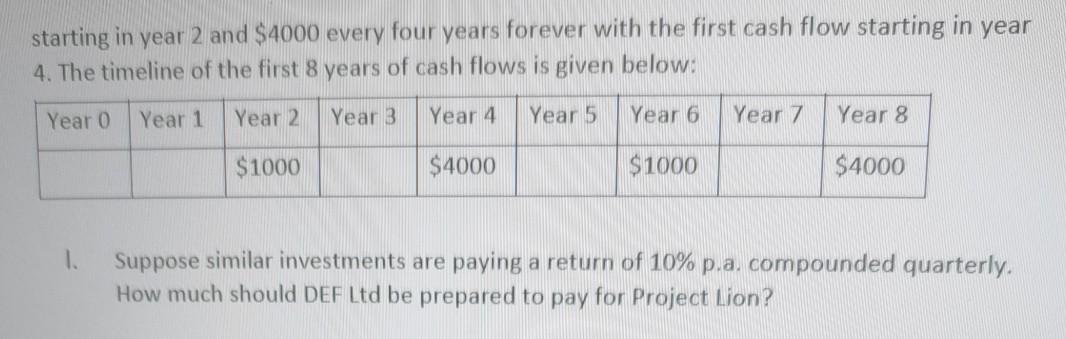

Question 3 20 marks Part A DEF Ltd is considering investing in a new project codenamed Project Lion. The project is expected to generate cash flows of $1000 every four years forever with the first cash flowTab starting in year 2 and $4000 every four years forever with the first cash flow starting in year 4. The timeline of the first 8 years of cash flows is given below: Year o Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 $1000 $4000 $1000 $4000 1. Suppose similar investments are paying a return of 10% p.a. compounded quarterly. How much should DEF Ltd be prepared to pay for Project Lion

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock