Question: Question 3 (20 marks) Part A. NNT Ltd pays no dividends and has a current stock price of $20 per share. Its returns have an

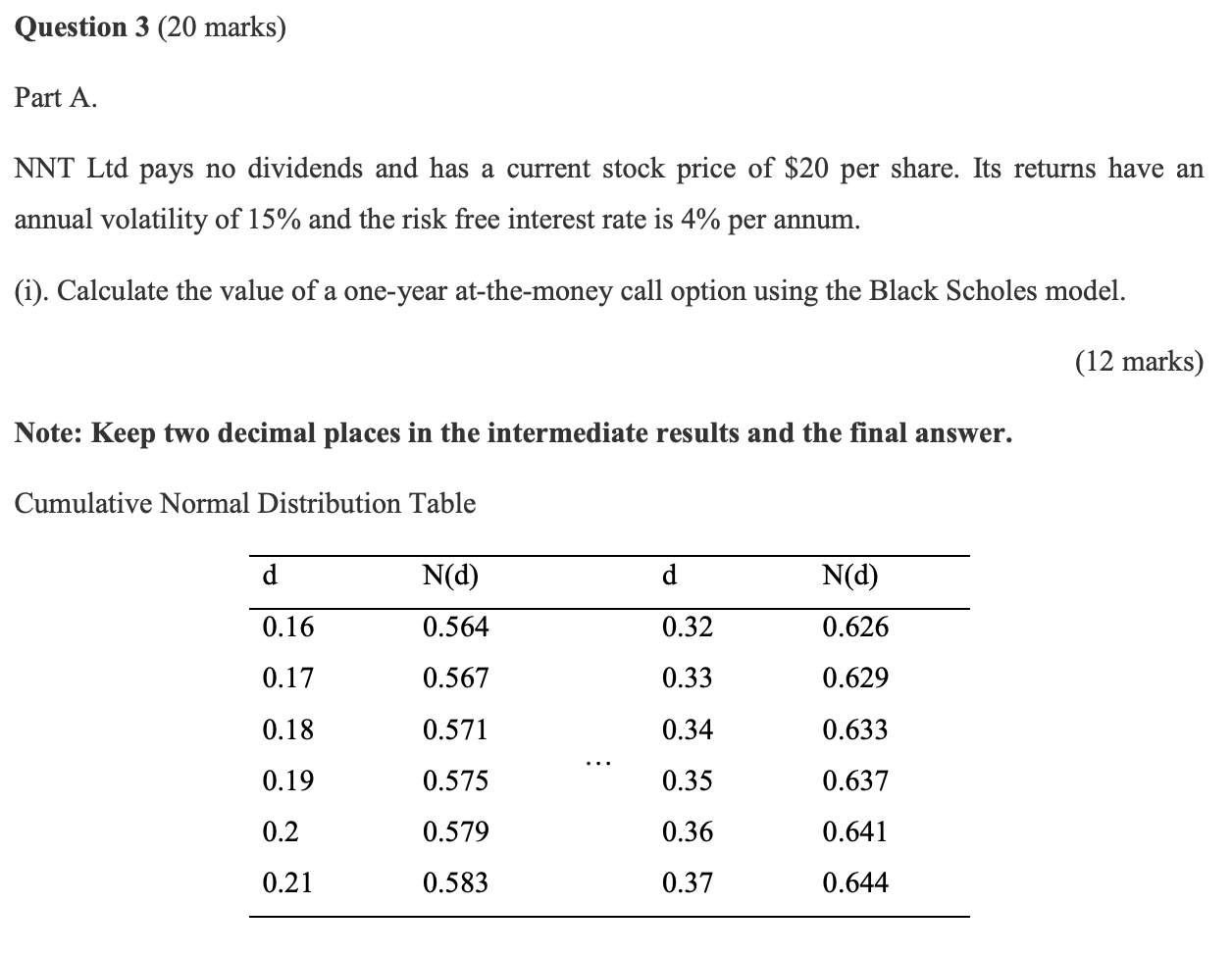

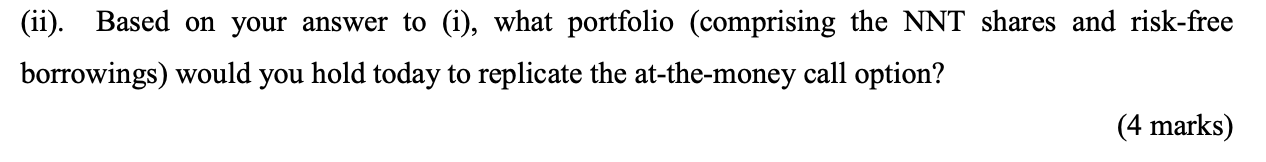

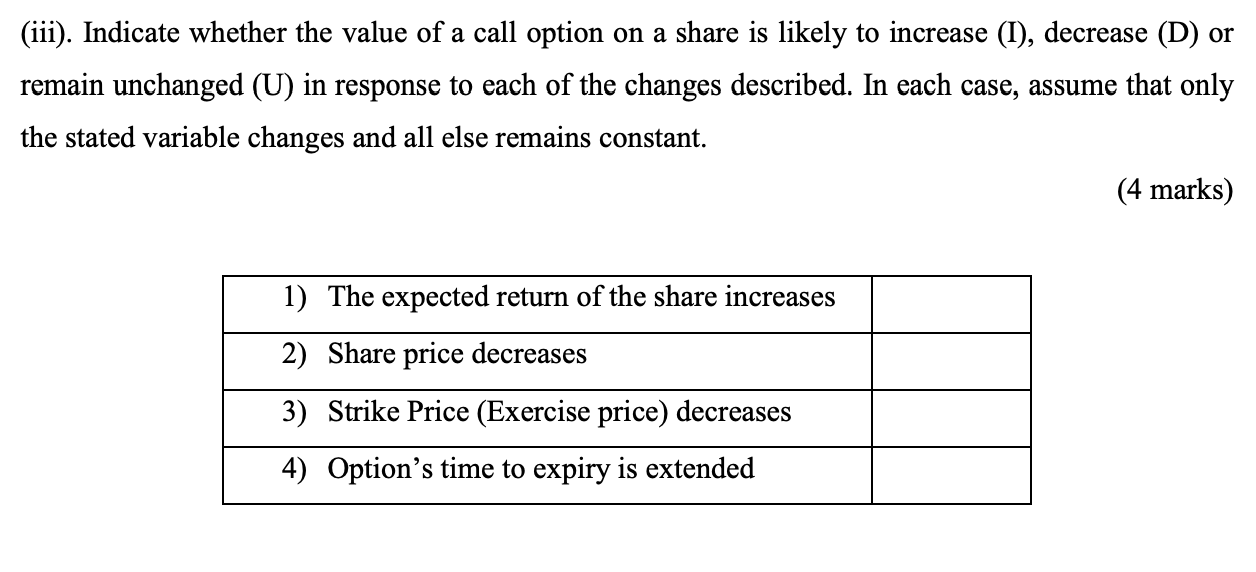

Question 3 (20 marks) Part A. NNT Ltd pays no dividends and has a current stock price of $20 per share. Its returns have an annual volatility of 15% and the risk free interest rate is 4% per annum. (i). Calculate the value of a one-year at-the-money call option using the Black Scholes model. (12 marks) Note: Keep two decimal places in the intermediate results and the final answer. Cumulative Normal Distribution Table d N(d) d N(d) 0.16 0.564 0.32 0.626 0.17 0.567 0.33 0.629 0.18 0.571 0.34 0.633 0.19 0.575 0.35 0.637 0.2 0.579 0.36 0.641 0.21 0.583 0.37 0.644 (ii). Based on your answer to (i), what portfolio (comprising the NNT shares and risk-free borrowings) would you hold today to replicate the at-the-money call option? (4 marks) (iii). Indicate whether the value of a call option on a share is likely to increase (I), decrease (D) or remain unchanged (U) in response to each of the changes described. In each case, assume that only the stated variable changes and all else remains constant. (4 marks) 1) The expected return of the share increases 2) Share price decreases 3) Strike Price (Exercise price) decreases 4) Option's time to expiry is extended Question 3 (20 marks) Part A. NNT Ltd pays no dividends and has a current stock price of $20 per share. Its returns have an annual volatility of 15% and the risk free interest rate is 4% per annum. (i). Calculate the value of a one-year at-the-money call option using the Black Scholes model. (12 marks) Note: Keep two decimal places in the intermediate results and the final answer. Cumulative Normal Distribution Table d N(d) d N(d) 0.16 0.564 0.32 0.626 0.17 0.567 0.33 0.629 0.18 0.571 0.34 0.633 0.19 0.575 0.35 0.637 0.2 0.579 0.36 0.641 0.21 0.583 0.37 0.644 (ii). Based on your answer to (i), what portfolio (comprising the NNT shares and risk-free borrowings) would you hold today to replicate the at-the-money call option? (4 marks) (iii). Indicate whether the value of a call option on a share is likely to increase (I), decrease (D) or remain unchanged (U) in response to each of the changes described. In each case, assume that only the stated variable changes and all else remains constant. (4 marks) 1) The expected return of the share increases 2) Share price decreases 3) Strike Price (Exercise price) decreases 4) Option's time to expiry is extended

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts