Question: QUESTION 3 (20 MARKS) t The following data has been provided concerning three securities in a portfolio. Security X Security Y Security Z Expected Return

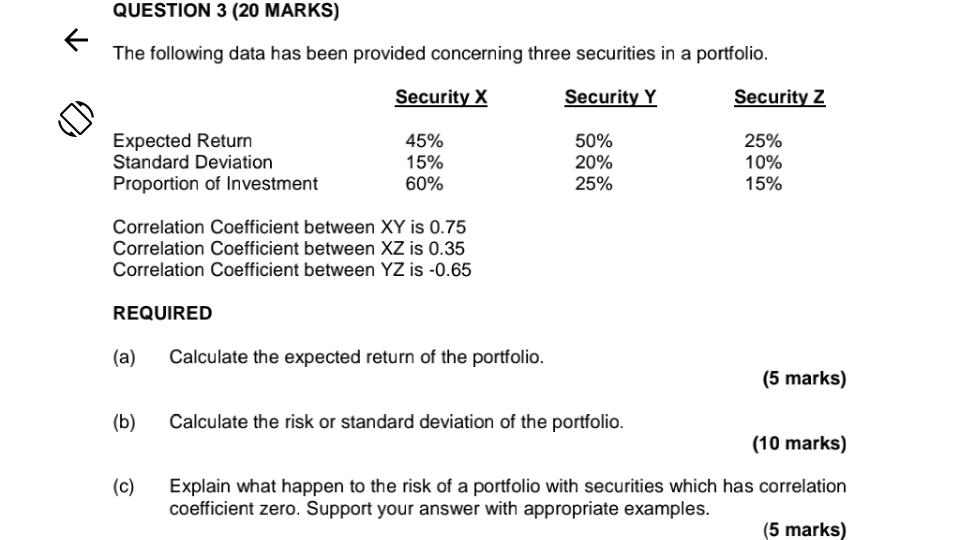

QUESTION 3 (20 MARKS) t The following data has been provided concerning three securities in a portfolio. Security X Security Y Security Z Expected Return Standard Deviation Proportion of Investment 45% 15% 60% 50% 20% 25% 25% 10% 15% Correlation coefficient between XY is 0.75 Correlation Coefficient between XZ is 0.35 Correlation Coefficient between YZ is -0.65 REQUIRED (a) Calculate the expected return of the portfolio. (5 marks) (b) Calculate the risk or standard deviation of the portfolio. (10 marks) C (c) Explain what happen to the risk of a portfolio with securities which has correlation coefficient zero. Support your answer with appropriate examples

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts