Question: QUESTION 3 24 points Save Answer Part 3 of 4: According to the IRS, which section of the IRC prevents the taxpayer from deducting business

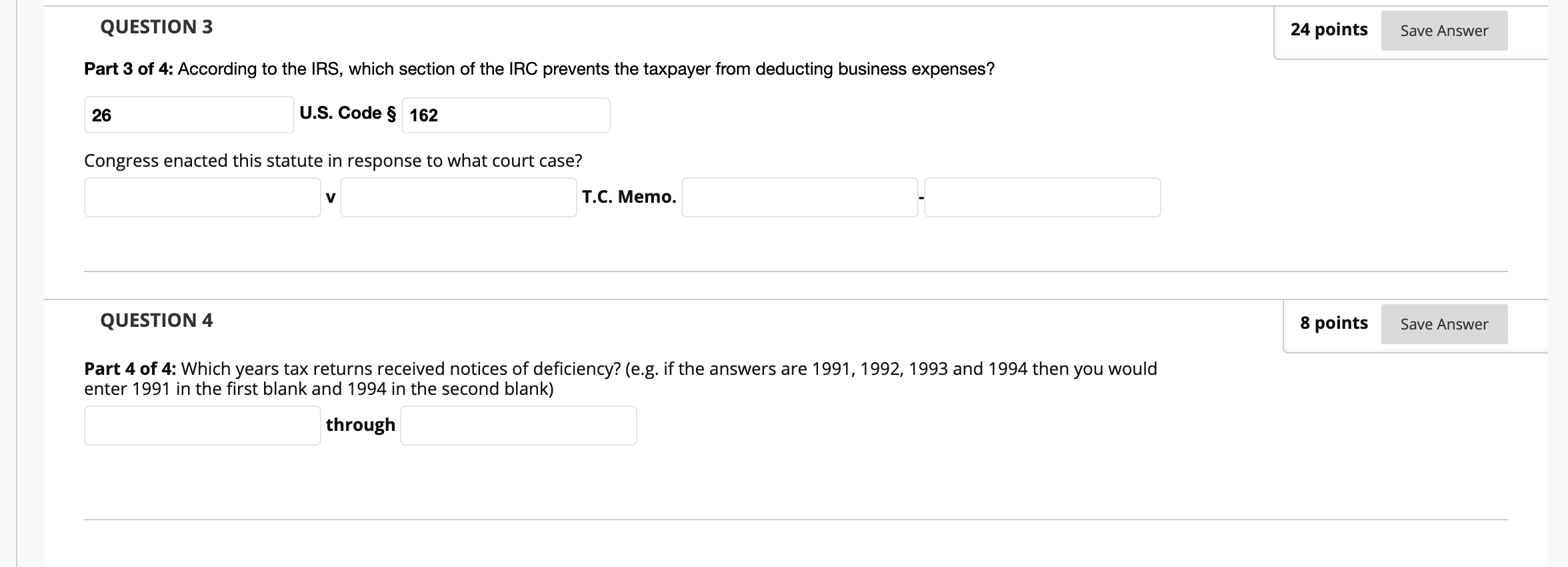

QUESTION 3 24 points Save Answer Part 3 of 4: According to the IRS, which section of the IRC prevents the taxpayer from deducting business expenses? 26 U.S. Code 162 Congress enacted this statute in response to what court case? T.C. Memo. QUESTION 4 8 points Save Answer Part 4 of 4: Which years tax returns received notices of deficiency? (e.g. if the answers are 1991, 1992, 1993 and 1994 then you would enter 1991 in the first blank and 1994 in the second blank) through QUESTION 3 24 points Save Answer Part 3 of 4: According to the IRS, which section of the IRC prevents the taxpayer from deducting business expenses? 26 U.S. Code 162 Congress enacted this statute in response to what court case? T.C. Memo. QUESTION 4 8 points Save Answer Part 4 of 4: Which years tax returns received notices of deficiency? (e.g. if the answers are 1991, 1992, 1993 and 1994 then you would enter 1991 in the first blank and 1994 in the second blank) through

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts