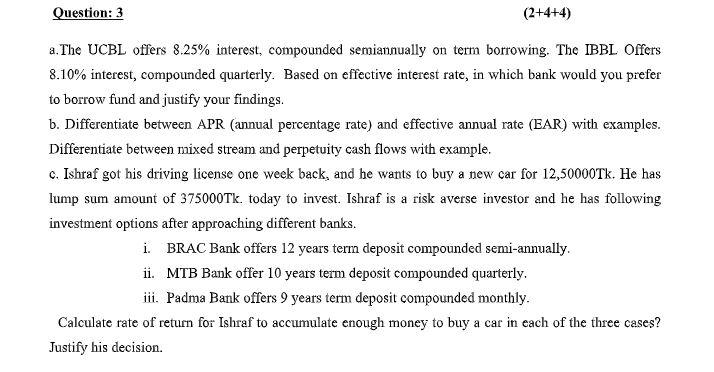

Question: Question: 3 (2+4+4) a. The UCBL offers 8.25% interest, compounded semiannually on term borrowing. The IBBL Offers 8.10% interest, compounded quarterly. Based on effective interest

Question: 3 (2+4+4) a. The UCBL offers 8.25% interest, compounded semiannually on term borrowing. The IBBL Offers 8.10% interest, compounded quarterly. Based on effective interest rate, in which bank would you prefer to borrow fund and justify your findings. b. Differentiate between APR (annual percentage rate) and effective annual rate (EAR) with examples. Differentiate between mixed stream and perpetuity cash flows with example. c. Ishraf got his driving license one week back, and he wants to buy a new car for 12,50000Tk. He has lump sum amount of 375000Tk. today to invest. Ishraf is a risk averse investor and he has following investment options after approaching different banks. i. BRAC Bank offers 12 years term deposit compounded semi-annually. ii. MTB Bank offer 10 years term deposit compounded quarterly, iii. Padma Bank offers 9 years term deposit compounded monthly. Calculate rate of return for Ishraf to accumulate enough money to buy a car in each of the three cases? Justify his decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts