Question: Question 3 (25 marks) A. James is considering a project which would cost $10,000 now. The annual benefits, for 4 years, would be a fixed

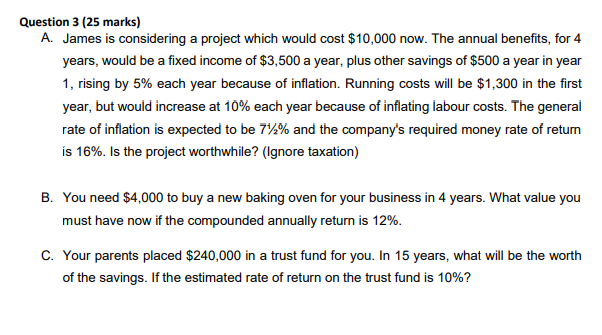

Question 3 (25 marks) A. James is considering a project which would cost $10,000 now. The annual benefits, for 4 years, would be a fixed income of $3,500 a year, plus other savings of $500 a year in year 1 , rising by 5% each year because of inflation. Running costs will be $1,300 in the first year, but would increase at 10% each year because of inflating labour costs. The general rate of inflation is expected to be 71/2% and the company's required money rate of return is 16%. Is the project worthwhile? (Ignore taxation) B. You need $4,000 to buy a new baking oven for your business in 4 years. What value you must have now if the compounded annually return is 12%. C. Your parents placed $240,000 in a trust fund for you. In 15 years, what will be the worth of the savings. If the estimated rate of return on the trust fund is 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts