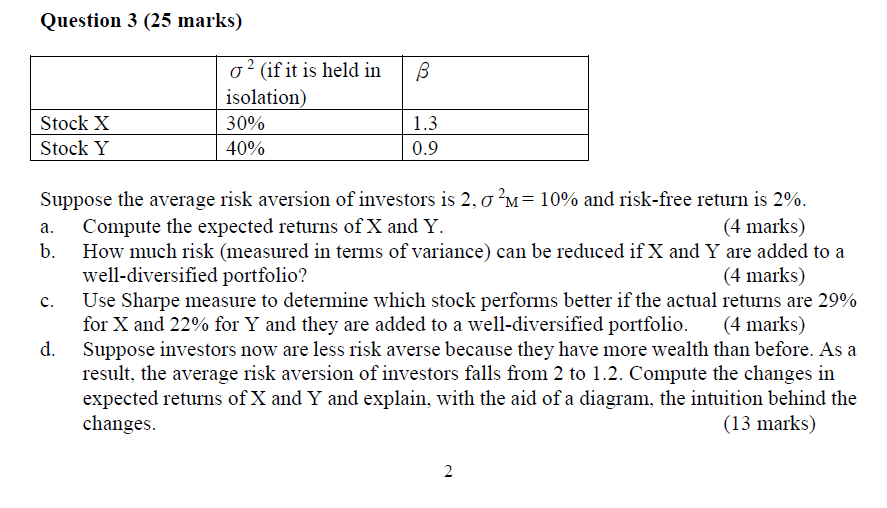

Question: Question 3 (25 marks) B 02 (if it is held in isolation) 30% 40% 1.3 Stock X Stock Y 0.9 a. Suppose the average risk

Question 3 (25 marks) B 02 (if it is held in isolation) 30% 40% 1.3 Stock X Stock Y 0.9 a. Suppose the average risk aversion of investors is 2,0?m= 10% and risk-free return is 2%. Compute the expected returns of X and Y. (4 marks) b. How much risk (measured in terms of variance) can be reduced if X and Y are added to a well-diversified portfolio? (4 marks) c. Use Sharpe measure to determine which stock performs better if the actual returns are 29% for X and 22% for Y and they are added to a well-diversified portfolio. (4 marks) d. Suppose investors now are less risk averse because they have more wealth than before. As a result, the average risk aversion of investors falls from 2 to 1.2. Compute the changes in expected returns of X and Y and explain, with the aid of a diagram, the intuition behind the changes. (13 marks) 2 Question 3 (25 marks) B 02 (if it is held in isolation) 30% 40% 1.3 Stock X Stock Y 0.9 a. Suppose the average risk aversion of investors is 2,0?m= 10% and risk-free return is 2%. Compute the expected returns of X and Y. (4 marks) b. How much risk (measured in terms of variance) can be reduced if X and Y are added to a well-diversified portfolio? (4 marks) c. Use Sharpe measure to determine which stock performs better if the actual returns are 29% for X and 22% for Y and they are added to a well-diversified portfolio. (4 marks) d. Suppose investors now are less risk averse because they have more wealth than before. As a result, the average risk aversion of investors falls from 2 to 1.2. Compute the changes in expected returns of X and Y and explain, with the aid of a diagram, the intuition behind the changes. (13 marks) 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts