Question: QUESTION 3 (25 Marks) Mr. Daniel is an executive at Summi Sdn. Bhd. with a salary of RM7,500.00 per month. He also made the normal

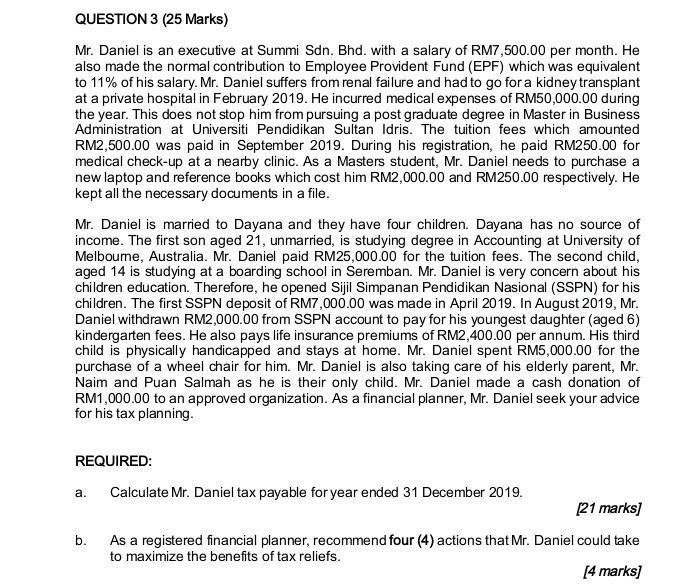

QUESTION 3 (25 Marks) Mr. Daniel is an executive at Summi Sdn. Bhd. with a salary of RM7,500.00 per month. He also made the normal contribution to Employee Provident Fund (EPF) which was equivalent to 11% of his salary. Mr. Daniel suffers from renal failure and had to go for a kidney transplant at a private hospital in February 2019. He incurred medical expenses of RM50,000.00 during the year. This does not stop him from pursuing a post graduate degree in Master in Business Administration at Universiti Pendidikan Sultan Idris. The tuition fees which amounted RM2,500.00 was paid in September 2019. During his registration, he paid RM250.00 for medical check-up at a nearby clinic. As a Masters student, Mr. Daniel needs to purchase a new laptop and reference books which cost him RM2,000.00 and RM250.00 respectively. He kept all the necessary documents in a file. Mr. Daniel is married to Dayana and they have four children. Dayana has no source of income. The first son aged 21, unmarried, is studying degree in Accounting at University of Melbourne, Australia. Mr. Daniel paid RM25,000.00 for the tuition fees. The second child, aged 14 is studying at a boarding school in Seremban. Mr. Daniel is very concern about his children education. Therefore, he opened Sijil Simpanan Pendidikan Nasional (SSPN) for his children. The first SSPN deposit of RM7,000.00 was made in April 2019. In August 2019, Mr. Daniel withdrawn RM2,000.00 from SSPN account to pay for his youngest daughter (aged 6) kindergarten fees. He also pays life insurance premiums of RM2,400.00 per annum. His third child is physically handicapped and stays at home. Mr. Daniel spent RM5,000.00 for the purchase of a wheel chair for him. Mr. Daniel is also taking care of his elderly parent, Mr. Naim and Puan Salmah as he is their only child. Mr. Daniel made a cash donation of RM1,000.00 to an approved organization. As a financial planner, Mr. Daniel seek your advice for his tax planning REQUIRED: a. Calculate Mr. Daniel tax payable for year ended 31 December 2019. (21 marks] As a registered financial planner, recommend four (4) actions that Mr. Daniel could take to maximize the benefits of tax reliefs. [4 marks] b. QUESTION 3 (25 Marks) Mr. Daniel is an executive at Summi Sdn. Bhd. with a salary of RM7,500.00 per month. He also made the normal contribution to Employee Provident Fund (EPF) which was equivalent to 11% of his salary. Mr. Daniel suffers from renal failure and had to go for a kidney transplant at a private hospital in February 2019. He incurred medical expenses of RM50,000.00 during the year. This does not stop him from pursuing a post graduate degree in Master in Business Administration at Universiti Pendidikan Sultan Idris. The tuition fees which amounted RM2,500.00 was paid in September 2019. During his registration, he paid RM250.00 for medical check-up at a nearby clinic. As a Masters student, Mr. Daniel needs to purchase a new laptop and reference books which cost him RM2,000.00 and RM250.00 respectively. He kept all the necessary documents in a file. Mr. Daniel is married to Dayana and they have four children. Dayana has no source of income. The first son aged 21, unmarried, is studying degree in Accounting at University of Melbourne, Australia. Mr. Daniel paid RM25,000.00 for the tuition fees. The second child, aged 14 is studying at a boarding school in Seremban. Mr. Daniel is very concern about his children education. Therefore, he opened Sijil Simpanan Pendidikan Nasional (SSPN) for his children. The first SSPN deposit of RM7,000.00 was made in April 2019. In August 2019, Mr. Daniel withdrawn RM2,000.00 from SSPN account to pay for his youngest daughter (aged 6) kindergarten fees. He also pays life insurance premiums of RM2,400.00 per annum. His third child is physically handicapped and stays at home. Mr. Daniel spent RM5,000.00 for the purchase of a wheel chair for him. Mr. Daniel is also taking care of his elderly parent, Mr. Naim and Puan Salmah as he is their only child. Mr. Daniel made a cash donation of RM1,000.00 to an approved organization. As a financial planner, Mr. Daniel seek your advice for his tax planning REQUIRED: a. Calculate Mr. Daniel tax payable for year ended 31 December 2019. (21 marks] As a registered financial planner, recommend four (4) actions that Mr. Daniel could take to maximize the benefits of tax reliefs. [4 marks] b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts