Question: Question 3 (25 points) Assume that Goffy is a constant growth company. The company promises a cash flow of $0.25 in the next year, that

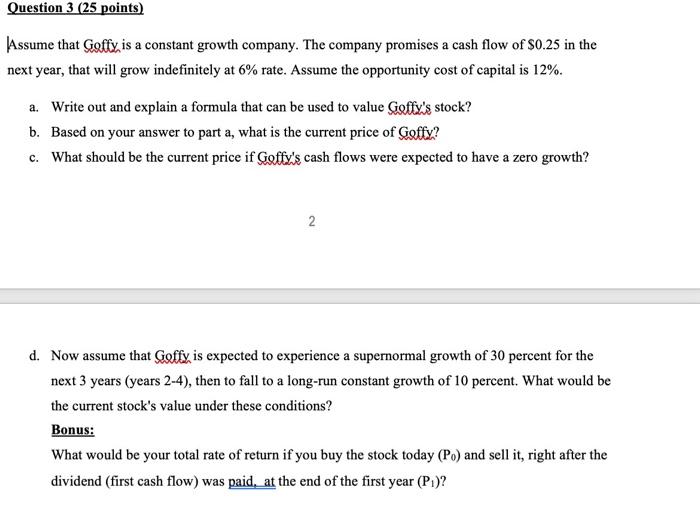

Question 3 (25 points) Assume that Goffy is a constant growth company. The company promises a cash flow of $0.25 in the next year, that will grow indefinitely at 6% rate. Assume the opportunity cost of capital is 12%. a. Write out and explain a formula that can be used to value Goffy's stock? b. Based on your answer to part a, what is the current price of Goffy? c. What should be the current price if Goffy's cash flows were expected to have a zero growth? 2 d. Now assume that Goffy, is expected to experience a supernormal growth of 30 percent for the next 3 years (years 2-4), then to fall to a long-run constant growth of 10 percent. What would be the current stock's value under these conditions? Bonus: What would be your total rate of return if you buy the stock today (Po) and sell it, right after the dividend (first cash flow) was paid, at the end of the first year (P.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts