Question: Question 3 3 pts The CAPM includes several elements including the risk free rate, the market risk premium (which is the current required rate of

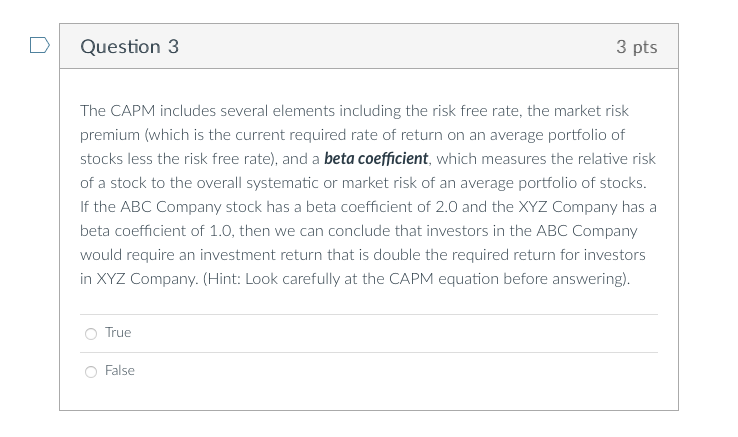

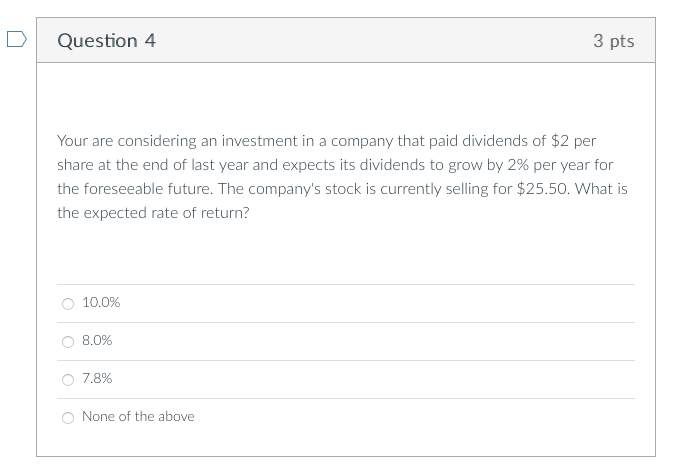

Question 3 3 pts The CAPM includes several elements including the risk free rate, the market risk premium (which is the current required rate of return on an average portfolio of stocks less the risk free rate), and a beta coefficient, which measures the relative risk of a stock to the overall systematic or market risk of an average portfolio of stocks. If the ABC Company stock has a beta coefficient of 2.0 and the XYZ Company has a beta coefficient of 1.0, then we can conclude that investors in the ABC Company would require an investment return that is double the required return for investors in XYZ Company. (Hint: Look carefully at the CAPM equation before answering). O True O False Question 4 3 pts Your are considering an investment in a company that paid dividends of $2 per share at the end of last year and expects its dividends to grow by 2% per year for the foreseeable future. The company's stock is currently selling for $25.50. What is the expected rate of return? 10.0% 8.0% 0 7.8% None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts