Question: Question 3 (30 points): Forwards on Treasury Notes In this problem we applying our W5E2 material to evaluate a LoOP implied forward price on a

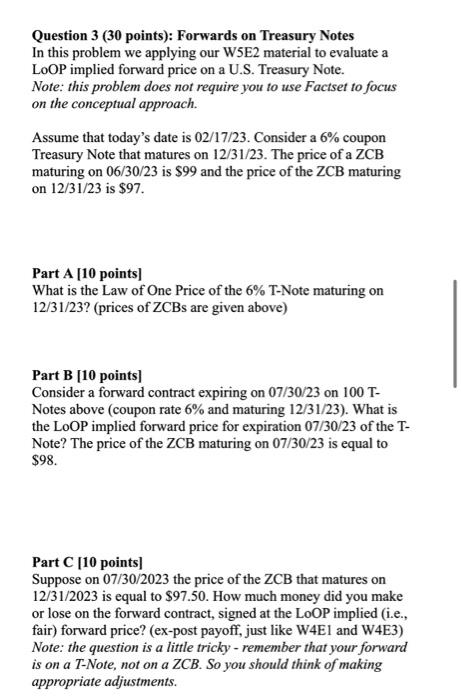

Question 3 (30 points): Forwards on Treasury Notes In this problem we applying our W5E2 material to evaluate a LoOP implied forward price on a U.S. Treasury Note. Note: this problem does not require you to use Factset to focus on the conceptual approach. Assume that today's date is 02/17/23. Consider a 6% coupon Treasury Note that matures on 12/31/23. The price of a ZCB maturing on 06/30/23 is $99 and the price of the ZCB maturing on 12/31/23 is $97. Part A [10 points] What is the Law of One Price of the 6% T-Note maturing on 12/31/23 ? (prices of ZCBs are given above) Part B [10 points] Consider a forward contract expiring on 07/30/23 on 100T Notes above (coupon rate 6% and maturing 12/31/23). What is the LoOP implied forward price for expiration 07/30/23 of the TNote? The price of the ZCB maturing on 07/30/23 is equal to $98. Part C [10 points] Suppose on 07/30/2023 the price of the ZCB that matures on 12/31/2023 is equal to $97.50. How much money did you make or lose on the forward contract, signed at the LoOP implied (i.e., fair) forward price? (ex-post payoff, just like W4E1 and W4E3) Note: the question is a little tricky - remember that your forward is on a T-Note, not on a ZCB. So you should think of making appropriate adjustments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts