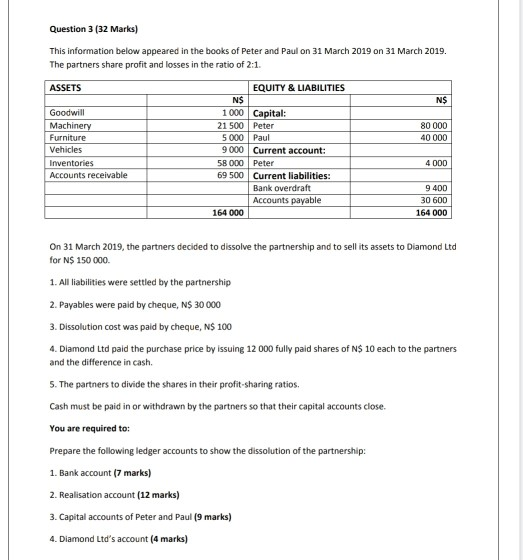

Question: Question 3 (32 Marks) This information below appeared in the books of Peter and Paul on 31 March 2019 on 31 March 2019. The partners

Question 3 (32 Marks) This information below appeared in the books of Peter and Paul on 31 March 2019 on 31 March 2019. The partners share profit and losses in the ratio of 2:1. ASSETS NS 80 000 40 000 Goodwill Machinery Furniture Vehicles Inventories Accounts receivable EQUITY & LIABILITIES NS 1000 Capital: 21 500 Peter 5000 Paul 9000 Current account: 58 000 Peter 69 500 Current liabilities: Bank overdraft Accounts payable 164 000 4 000 9 400 30 600 164 000 On 31 March 2019, the partners decided to dissolve the partnership and to sell its assets to Diamond Ltd for N$ 150 000 1. All liabilities were settled by the partnership 2. Payables were paid by cheque, N$ 30 000 3. Dissolution cost was paid by cheque, N$ 100 4. Diamond Ltd paid the purchase price by issuing 12 000 fully paid shares of N$ 10 each to the partners and the difference in cash. 5. The partners to divide the shares in their profit-sharing ratios. Cash must be paid in or withdrawn by the partners so that their capital accounts close. You are required to: Prepare the following ledger accounts to show the dissolution of the partnership 1. Bank account (7 marks) 2. Realisation account (12 marks) 3. Capital accounts of Peter and Paul (9 marks) 4. Diamond Ltd's account (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts