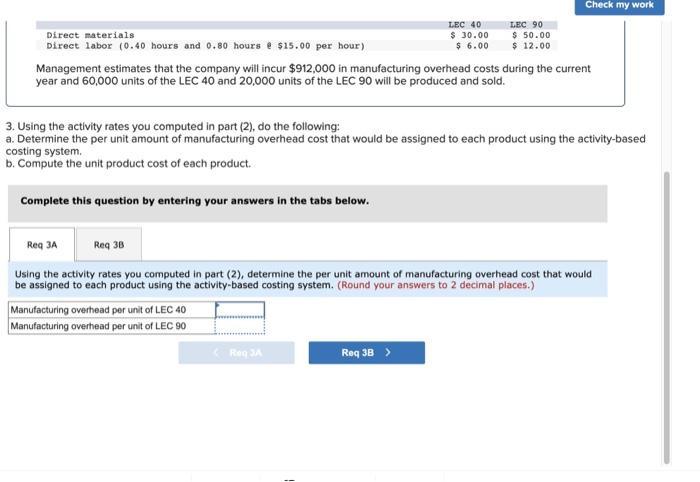

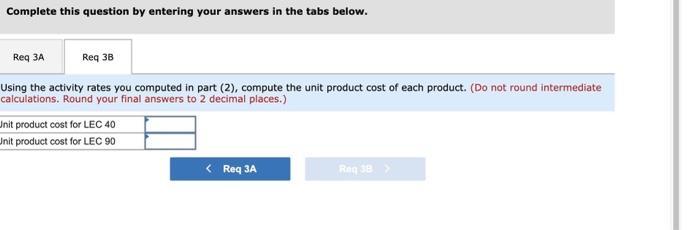

Question: question 3 3a 3b 2. Management is considering using activity-based costing to assign manufacturing overhead cost to products. The activity-based costing system would have the

![Required information [The following information applies to the questions displayed below.] For many years, Thomson Company ma](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/02/63e48050bb3d9_1675919440051.png)

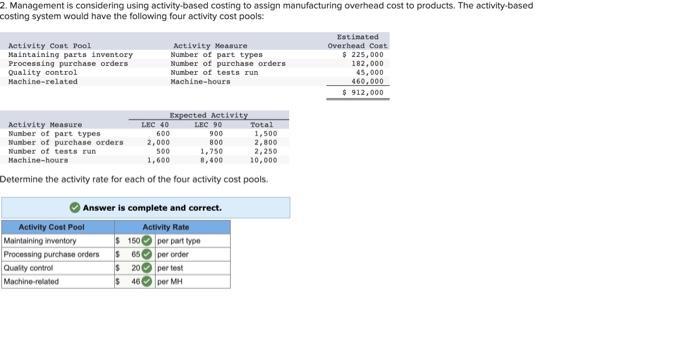

2. Management is considering using activity-based costing to assign manufacturing overhead cost to products. The activity-based costing system would have the following four activity cost pools: Activity Cost Pool Maintaining parts inventory Processing purchase orders Quality control Machine-related Activity Measure Number of part types Number of purchase orders Number of tests run Machine-hours LEC 40 600 2,000 500 1,750 1,600 8,400 Determine the activity rate for each of the four activity cost pools. Activity Cost Pool Activity Measure Number of part types. Number of purchase orders Number of tests run Machine-hours Answer is complete and correct. Activity Rate Maintaining inventory Processing purchase orders Quality control Machine-related Expected Activity LEC 90 900 800 $ 150 $ 65 $ 20 $ 46 Total per part type per order per test per MH 1,500 2,800 2,250 10,000 Estimated Overhead Cost $ 225,000 182,000 45,000 460,000 $912,000

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Activity based concept states that costs should be recognized on the ba... View full answer

Get step-by-step solutions from verified subject matter experts