Question: Question 3 (4 points) On August 1, 20X1 BAA Ltd. (a lessor) leased an asset with a fair value of $20,000 to a customer.

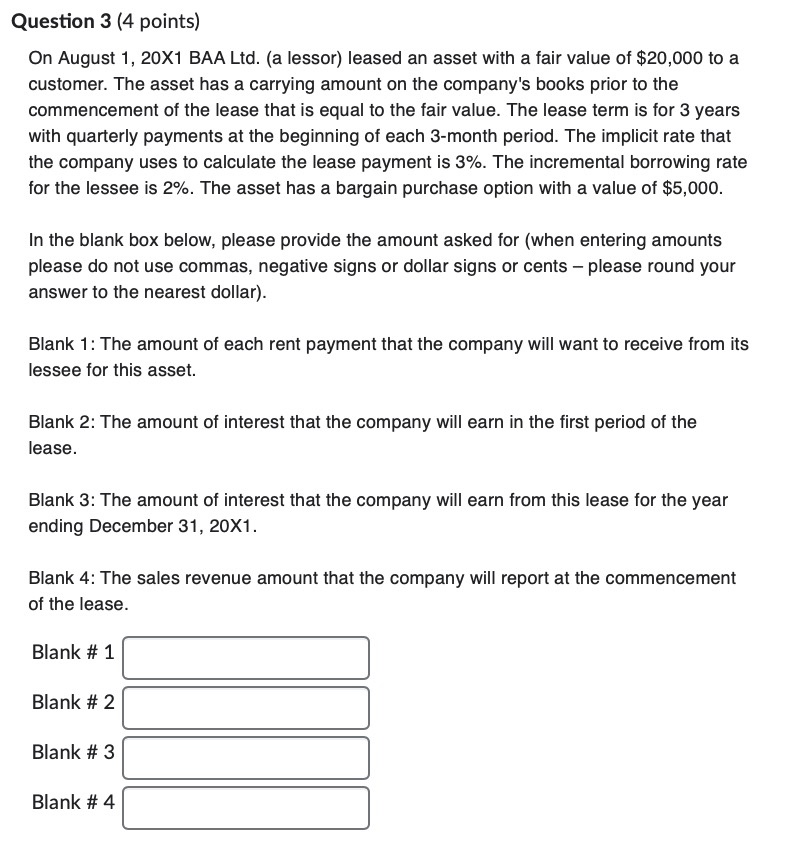

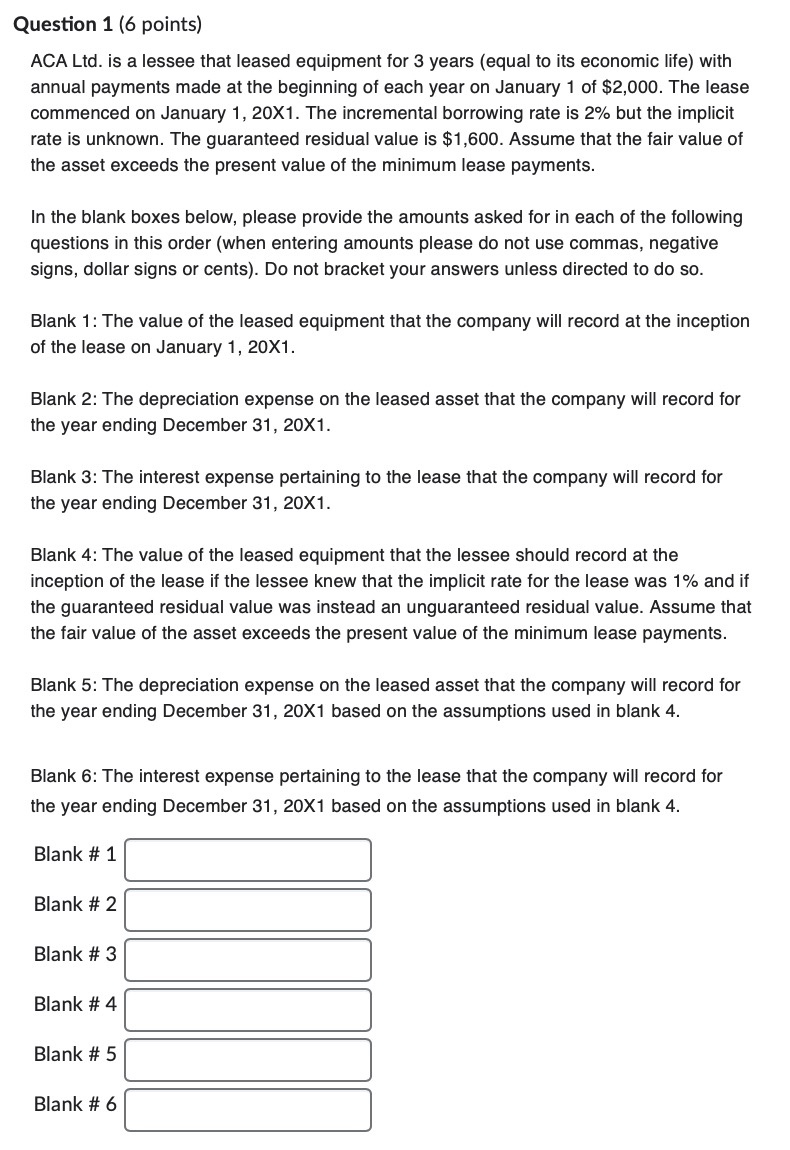

Question 3 (4 points) On August 1, 20X1 BAA Ltd. (a lessor) leased an asset with a fair value of $20,000 to a customer. The asset has a carrying amount on the company's books prior to the commencement of the lease that is equal to the fair value. The lease term is for 3 years with quarterly payments at the beginning of each 3-month period. The implicit rate that the company uses to calculate the lease payment is 3%. The incremental borrowing rate for the lessee is 2%. The asset has a bargain purchase option with a value of $5,000. In the blank box below, please provide the amount asked for (when entering amounts please do not use commas, negative signs or dollar signs or cents - please round your answer to the nearest dollar). Blank 1: The amount of each rent payment that the company will want to receive from its lessee for this asset. Blank 2: The amount of interest that the company will earn in the first period of the lease. Blank 3: The amount of interest that the company will earn from this lease for the year ending December 31, 20X1. Blank 4: The sales revenue amount that the company will report at the commencement of the lease. Blank # 1 Blank # 2 Blank # 3 Blank # 4 Question 1 (6 points) ACA Ltd. is a lessee that leased equipment for 3 years (equal to its economic life) with annual payments made at the beginning of each year on January 1 of $2,000. The lease commenced on January 1, 20X1. The incremental borrowing rate is 2% but the implicit rate is unknown. The guaranteed residual value is $1,600. Assume that the fair value of the asset exceeds the present value of the minimum lease payments. In the blank boxes below, please provide the amounts asked for in each of the following questions in this order (when entering amounts please do not use commas, negative signs, dollar signs or cents). Do not bracket your answers unless directed to do so. Blank 1: The value of the leased equipment that the company will record at the inception of the lease on January 1, 20X1. Blank 2: The depreciation expense on the leased asset that the company will record for the year ending December 31, 20X1. Blank 3: The interest expense pertaining to the lease that the company will record for the year ending December 31, 20X1. Blank 4: The value of the leased equipment that the lessee should record at the inception of the lease if the lessee knew that the implicit rate for the lease was 1% and if the guaranteed residual value was instead an unguaranteed residual value. Assume that the fair value of the asset exceeds the present value of the minimum lease payments. Blank 5: The depreciation expense on the leased asset that the company will record for the year ending December 31, 20X1 based on the assumptions used in blank 4. Blank 6: The interest expense pertaining to the lease that the company will record for the year ending December 31, 20X1 based on the assumptions used in blank 4. Blank # 1 Blank # 2 Blank # 3 Blank # 4 Blank # 5 Blank # 6

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Question 1 Blank 1 The amount of each rent payment that the company will want to receive from its lessee for this asset Blank 1200005000 1100312 003 B... View full answer

Get step-by-step solutions from verified subject matter experts