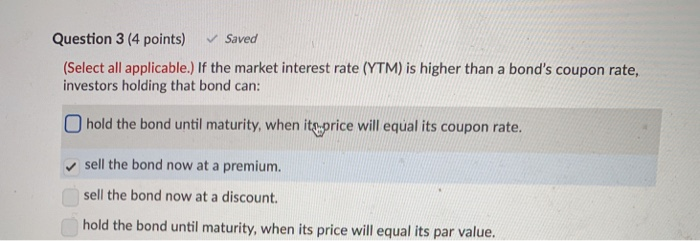

Question: Question 3 (4 points) Saved (Select all applicable.) If the market interest rate (YTM) is higher than a bond's coupon rate, investors holding that bond

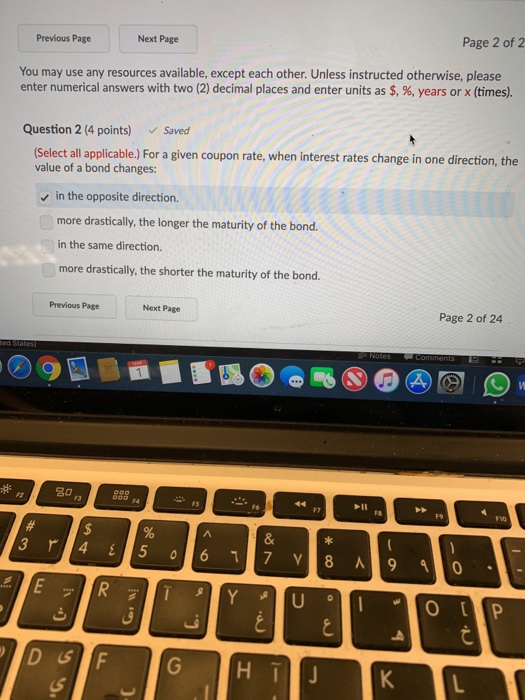

Question 3 (4 points) Saved (Select all applicable.) If the market interest rate (YTM) is higher than a bond's coupon rate, investors holding that bond can: O hold the bond until maturity, when itgprice will equal its coupon rate sell the bond now at a premium. sell the bond now at a discount. hold the bond until maturity, when its price will equal its par value. Next Page Page 2 of 2 Previous Page You may use any resources available, except each other. Unless instructed otherwise, please enter numerical answers with two (2) decimal places and enter units as $, %, years or x (times). Question 2 (4 points) Saved (Select all applicable.) For a given coupon rate, when interest rates change in one direction, the value of a bond changes: in the opposite direction. more drastically, the longer the maturity of the boned. in the same direction. more drastically, the shorter the maturity of the bond. Previous Page Next Page Page 2 of 24 0 889 FS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts