Question: QUESTION 11 Practice finding Present Value for Semi-annual Bonds See Section 7-6 of the Textbook. Consider corporate bonds with PMT: a coupon rate of 5%

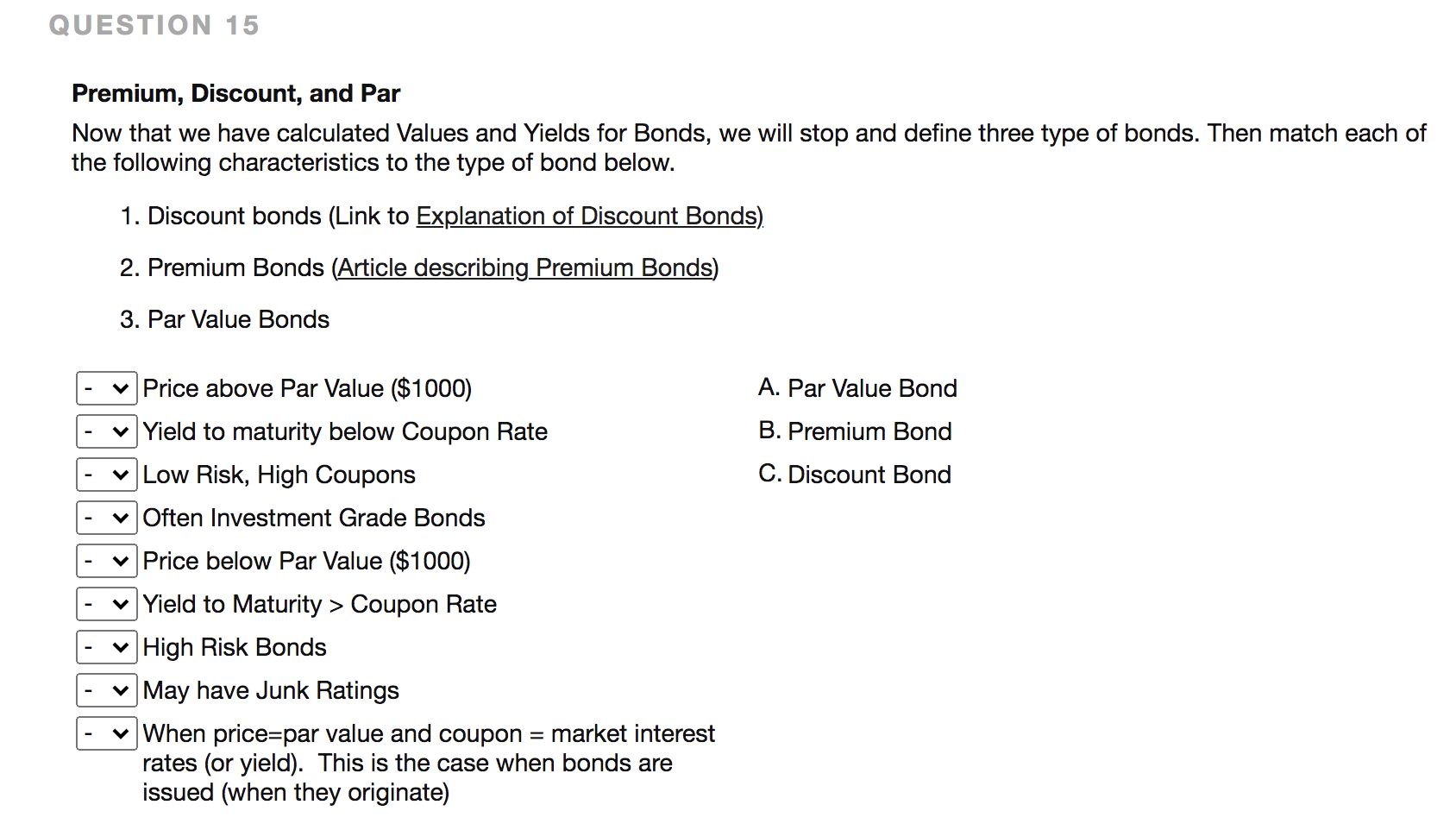

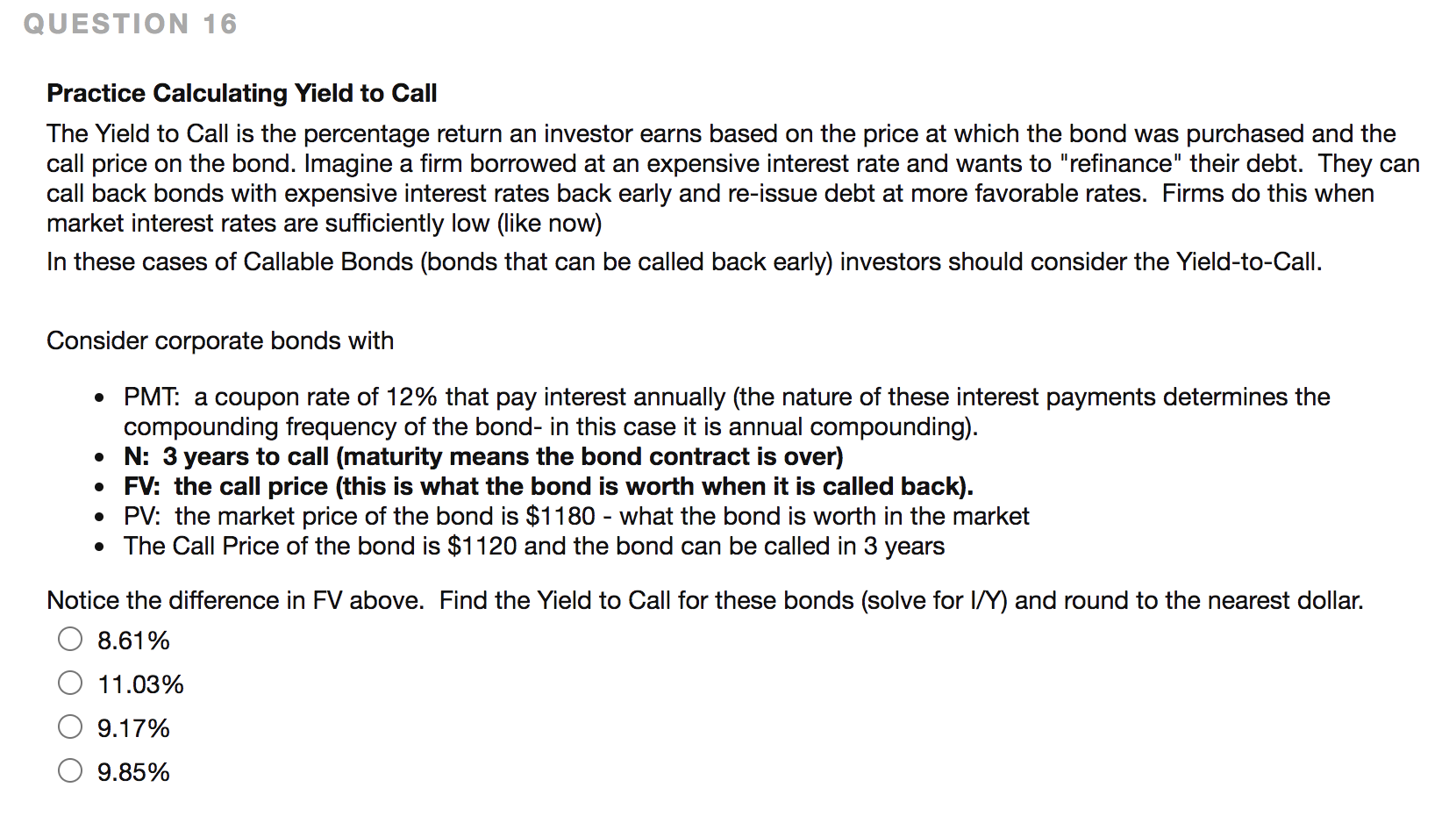

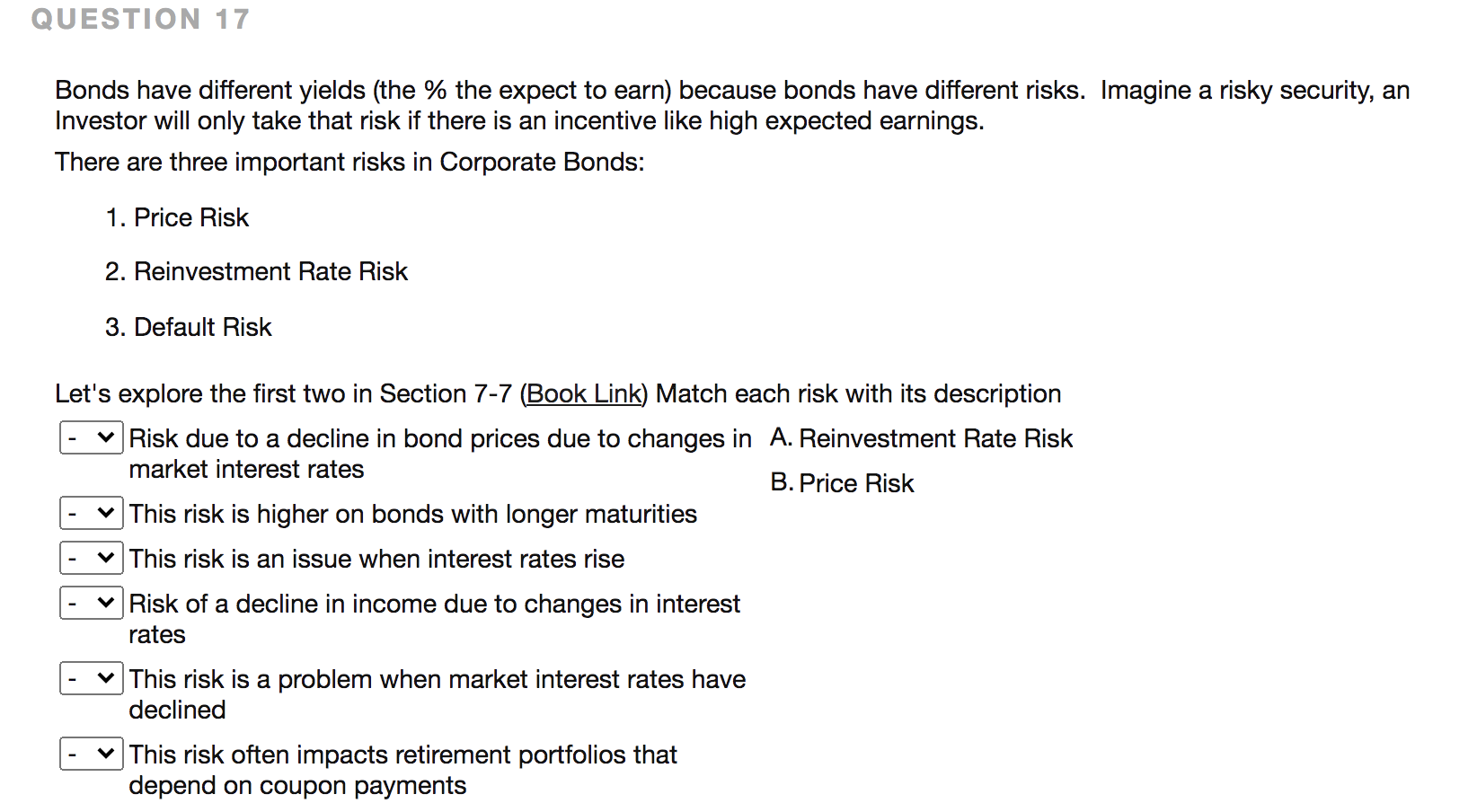

QUESTION 11 Practice finding Present Value for Semi-annual Bonds See Section 7-6 of the Textbook. Consider corporate bonds with PMT: a coupon rate of 5% (the coupon rate is expressed as an annual number) that pay interest semi-annually (the nature of these interest payments determines the compounding frequency of the bond- in this case it is semi-annual compounding). So we need to take the coupon rate and divide by 2 N: 6 years to maturity (maturity means the bond contract is over) this is provided in years, but we need the number of periods. so use years*2 for N FV: a par value of $1,000 (this is what the bond is worth at maturity) - this is unaffected by semi-annual compounding I/Y: the market rate of interest on similar debt is 9%. Interest rates are quoted as annual numbers, so we need the semi-annual rate. use rate / 2 for INY Find the value of these bonds (solve for PV) and round to the nearest dollar QUESTION 12 Price and Maturity Read Section 7-5 How a bond's Value Changes over time with special attention to Figure 7.2 (Link to 7-5) How about a practical example... Take a look below at Apple Bonds: (Finra Bond Center Link). click the Finra Bond Center link above select the Search Tab Type AAPL for Symbol/CUSIP and click "Show Results" answer the user agreement What do you notice about the time to maturity and price (select an answer below) Look for example at the following two bonds A bond that doesn't expire until 2043 A bond that expires in 2021 Consider which bond is closer to the $100 par value Be sure to read section 7-5! . Optional: Here is another interesting article about Apple's financial capital structure and its use of bonds: "Apple sells $14 billion of bonds..." As a bond nears expiration the market price diverges from par value As a bond nears expiration the market price converges to par value As a bond nears expiration the market price converges to the coupon payment As a bond nears expiration the market price converges to the yield QUESTION 13 Practice Calculating Yield to Maturity The yield to maturity is the percentage return an investor expects to earn by investing in the bond at the current market price and holding the bond until it matures. This is often called simply "yield". In prior problems above, we used the market interest rate to find the bond value (CPT PV). In these problems, we flip our frame work and find the yield (CPT I/Y) using the market price as the present value. Consider corporate bonds with PMT: a coupon rate of 9% that pay interest annually (the nature of these interest payments determines the compounding frequency of the bond- in this case it is annual compounding). N: 4 years to maturity (maturity means the bond contract is over) FV: a par value of $1,000 (this is what the bond is worth at maturity). PV: the market price of the bond is $984 - what the bond is worth in the market Find the yield tto maturity for these bonds (solve for I/Y) 10.77% 9.499% 8.506% 9% QUESTION 14 Practice Calculating Yield to Maturity for Semi-Annual Bonds Be Mindful of Changing N and PMT, and be careful with your output Consider corporate bonds with PMT: a coupon rate of 6.4% that pay interest annually (the nature of these interest payments determines the compounding frequency of the bond- in this case it is annual compounding). (3.2% = 6.4 /2) N: 8 years to maturity (maturity means the bond contract is over) (16 = 8*2) FV: a par value of $1,000 (this is what the bond is worth at maturity). PV: the market price of the bond is $882 - what the bond is worth in the market Find the yield to maturity for these bonds (solve for I/Y). Be careful, the I/ is the semi-annual yeild. We need the annual yeild. So your IN * 2 is the answer 5.02% 4.23% 8.46% 3.2% QUESTION 15 Premium, Discount, and Par Now that we have calculated Values and Yields for Bonds, we will stop and define three type of bonds. Then match each of the following characteristics to the type of bond below. 1. Discount bonds (Link to Explanation of Discount Bonds) 2. Premium Bonds (Article describing Premium Bonds) 3. Par Value Bonds A. Par Value Bond B. Premium Bond C. Discount Bond v Price above Par Value ($1000) Yield to maturity below Coupon Rate v Low Risk, High Coupons v Often Investment Grade Bonds v Price below Par Value ($1000) v Yield to Maturity > Coupon Rate v High Risk Bonds v May have Junk Ratings v When price=par value and coupon market interest rates (or yield). This is the case when bonds are issued (when they originate) QUESTION 16 Practice Calculating Yield to Call The Yield to Call is the percentage return an investor earns based on the price at which the bond was purchased and the call price on the bond. Imagine a firm borrowed at an expensive interest rate and wants to "refinance" their debt. They can call back bonds with expensive interest rates back early and re-issue debt at more favorable rates. Firms do this when market interest rates are sufficiently low (like now) In these cases of Callable Bonds (bonds that can be called back early) investors should consider the Yield-to-Call. Consider corporate bonds with PMT: a coupon rate of 12% that pay interest annually (the nature of these interest payments determines the compounding frequency of the bond- in this case it is annual compounding). N: 3 years to call (maturity means the bond contract is over) FV: the call price (this is what the bond is worth when it is called back). PV: the market price of the bond is $1180 - what the bond is worth in the market The Call Price of the bond is $1120 and the bond can be called in 3 years Notice the difference in FV above. Find the Yield to Call for these bonds (solve for I/Y) and round to the nearest dollar. 8.61% 11.03% 9.17% 9.85% QUESTION 17 Bonds have different yields (the % the expect to earn) because bonds have different risks. Imagine a risky security, an Investor will only take that risk if there is an incentive like high expected earnings. There are three important risks in Corporate Bonds: 1. Price Risk 2. Reinvestment Rate Risk 3. Default Risk Let's explore the first two in Section 7-7 (Book Link) Match each risk with its description Risk due to a decline in bond prices due to changes in A. Reinvestment Rate Risk market interest rates B. Price Risk This risk is higher on bonds with longer maturities This risk is an issue when interest rates rise Risk of a decline in income due to changes in interest rates v This risk is a problem when market interest rates have declined This risk often impacts retirement portfolios that depend on coupon payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts