Question: Question 3: 5 marks Using Direct Method, calculate cash flow from Operating activities: XYZ Company's worksheet for the preparation of its 2021 statement of cash

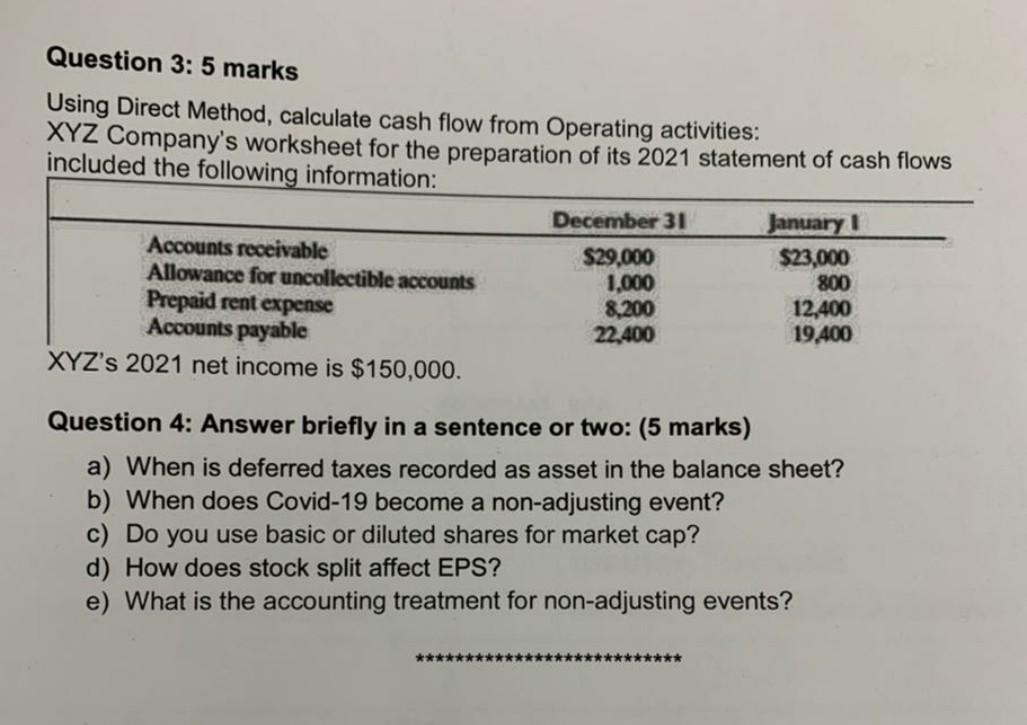

Question 3: 5 marks Using Direct Method, calculate cash flow from Operating activities: XYZ Company's worksheet for the preparation of its 2021 statement of cash flows included the following information: December 31 January 1 Accounts receivable $29.000 $23,000 Allowance for uncollectible accounts 1.000 800 Prepaid rent expense 8.200 12,400 Accounts payable 22,400 19,400 XYZ's 2021 net income is $150,000. Question 4: Answer briefly in a sentence or two: (5 marks) a) When is deferred taxes recorded as asset in the balance sheet? b) When does Covid-19 become a non-adjusting event? c) Do you use basic or diluted shares for market cap? d) How does stock split affect EPS? e) What is the accounting treatment for non-adjusting events? ******

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts